After any U.S. market holiday, it’s a good idea to get your head back in the game before you start trading again. Here’s how I take action…

Understand Time

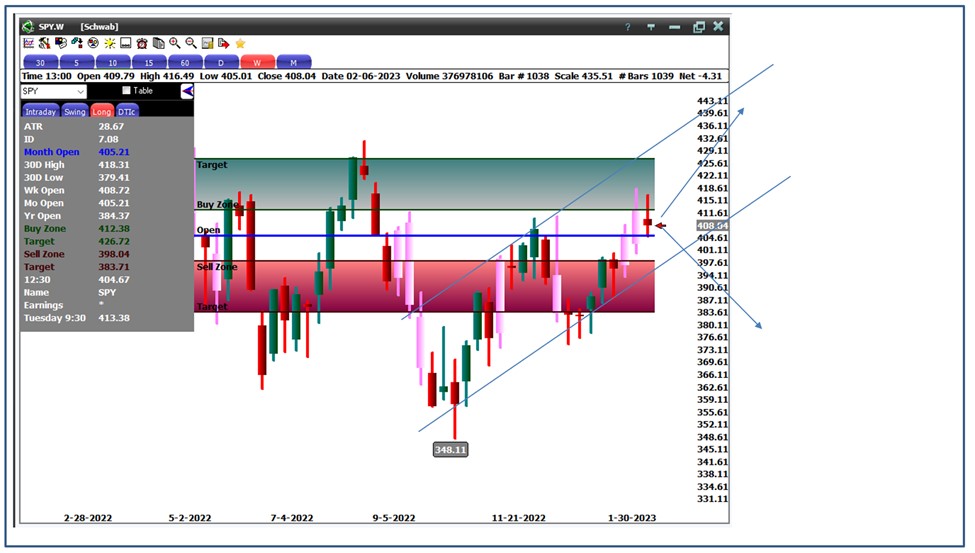

The first place I go is the S&P 500 for a perspective based on time frames.

We’re below February’s month open and coming off some strong overbought territories from a daily perspective. This is a strong case for the bears, but the markets have “climbed a wall of worry” since early October, which is what bulls do.

As shown in this weekly chart of the SPDR S&P 500 ETF Trust (NYSEArca: SPY), we’re in the middle of a nearly five-month trend. From here, this week of the second month of the first quarter, we head up or down… simple as that.

With only six trading days left for the month of February, both bears and bulls are on the line.

We must understand the implications of time…

Review Economic News Event Dates

Reviewing the week’s topics on a site like Econoday.com is a great way to start the post-holiday process.

This week, we get to read the Federal Open Market Committee’s minutes from its last meeting, when it raised its benchmark interest rate another 0.25% — that will be fun! Oh my!

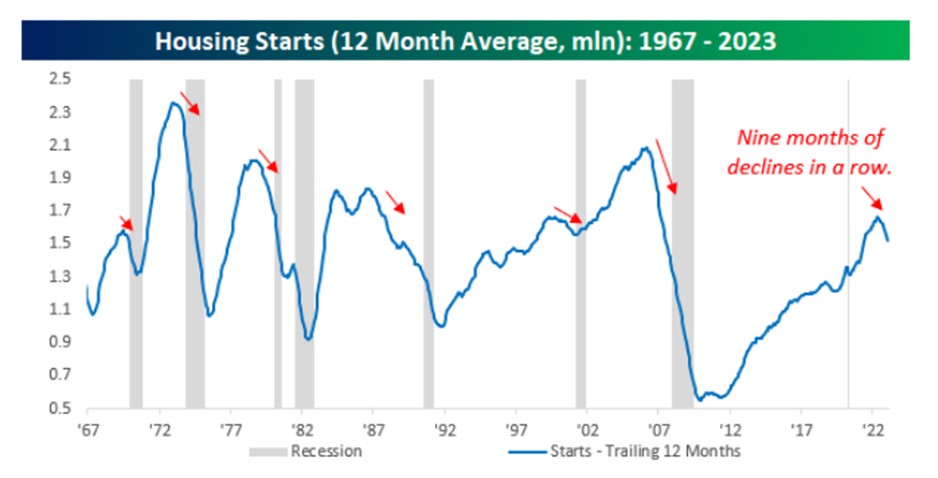

We also find out about housing, the Purchasing Managers Index, the latest jobs data and consumer sentiment.

There’s also a “small” number coming out on Thursday… GDP. I jest because that’s the number recessionary pundits and all others are eyeing. Understandably so because it could definitely mix things up a bit.

Speaking of mixing things up…

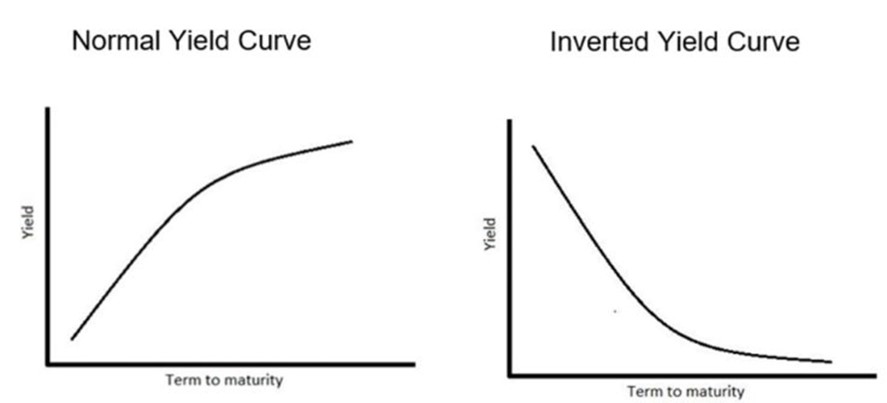

Are you aware that the man behind one of the best recession indicators — a yield curve inversion — reversed his position for this recent inversion ?

The inverted yield curve — which is when short-dated interest rates have a higher yield than long-term rates — has successfully pointed to U.S. recessions since the late 1960s. Economist Campbell Harvey first discovered this, as shown in his dissertation at the University of Chicago.

He’s been 8 for 8 since then — and “with no false alarms,” he said during a recent interview…

“I have reasons to believe, however, that it is flashing a false signal,” Harvey said about this latest inversion.

Why? The main reason he says is because of the employment situation. The demand for labor is still strong, even in the midst of large tech layoffs.

Remain Flexible

The best approach for any week, however, is to remain flexible. Put bias aside and trade by rules. This will help you get on the right side of the market, whichever direction it takes.

Have trade approaches that take advantage of up, down and sideways moves.

Doing so puts the diversification into your portfolio that so many traders are missing.

February will end. Bear markets will end, as will bull markets. Even the trend will end. You know all of this.

The way to stay alive and succeed in trading markets is to know when to bend.

Think and win!

Celeste Lindman

P.S. Calling All People Looking For a New Way to Trade

I’m not signing you up for an overnight shift, or having you pick up extra hours. You don’t need any exotic financial trading…

In fact, Jack Carter of Jack Carter Trading, wants to show you his speedy way of targeting this income, right here, right now.