The words “Trust but Verify” are typically tied to Ronald Reagan. But a simple internet search will tell you that everyone from Bugs Bunny to Mikheil Gorbachov have uttered the words.

The term received international recognition after the American scholar Suzanne Massie taught it to Reagan during his presidency. It actually harkens back to phrases used by Lenin and Stalin, which warms no one’s hearts.

Today, I want to talk about our own version of “Trust but Verify” in the markets. As a quantitative analyst, I spend a lot of time digging into numbers and looking for value.

I want to talk about why qualification is so much MORE important. The numbers only tell you so much.

The “verification” tells you the truth.

Avoiding an Error

When we think about value, we go back to the Buffett adage that price is what you pay, but value is what you get.

One of my preferred long-term, value-oriented approaches is to combine the work of Stanford professor Joseph Piotroski and the Godfather of Value Investing, Ben Graham.

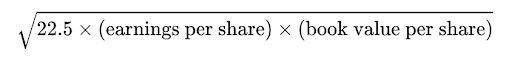

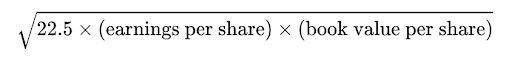

We combine strong balance sheet analysis with the Piotroski F score with the value metric of the Graham number.

The F Score gives us a strong analysis of the companies with shareholder’s interest at heart.

As I’ve explained in previous articles, the F score rewards companies a point for every positive action on Piotroski’s list.

An annual increase in “Return on Assets” generates a point. The effort to reduce outstanding shares generates a point. The action to reduce leverage and debt, gives a point.

We are always looking for companies with a score of 7 or more.

On the Graham side, we use the Graham number to define a defensive value on each stock.

A Graham score is a specific metric that tells us what a value investor should be comfortable paying. It represents a rather complex bit of high school mathematics that involves the company’s earnings per share and its book value.

The combination of strong F scores and low Graham numbers (typically looking under 0.50) gives us a list of about 40 names to examine.

There are plenty of energy names, housing stocks, natural gas players, and developers of the things we need. Value exists within this list…

But when we look at it, we also see a few names that stick out.

Names like American International Group (AIG)…

And even a name like Silvergate Capital Corporation (SI).

This is where the verification process starts.

Trust But Qualify

As an investor, the most important question you should ask is… “Why?”

Why is this opportunity now presented to me in this specific market?

Why is a company like Silvergate Capital – with an F score of 7 and VERY LOW Graham number giving me this chance to own it?

Well, once you look under the hood, you’ll find a company going out of business.

Silvergate announced last night that it will liquidate its bank holdings, as the fallout from its relationship with cryptocurrency giant FTX accelerates.

That said, the “value opportunity” in Silvergate emerged a few weeks ago. That’s when the stock pulled back and presented this opportunity. By digging under the hood, one could have determined that significant risk existed.

What exactly does this company have as collateral? Bitcoin? What does it make that can be sold at auction if something goes wrong? A bunch of debt obligations?

It’s not enough just to look at the numbers and buy the stock…

You must remember that when you purchase a stock, you’re buying a business. Oil, housing, food commodities, and the other things we need as good businesses for the long-term.

A leveraged bank with massive exposure to crypto isn’t “Value.”

It’s a liability.

And it proved so this week.

Remember, if you want to know the best stocks that meet these value requirements, I can do all of the qualifying for investors. In fact, I also explain why these opportunities exist in my Tactical Wealth Investor.

We just sold one of our value stocks at nearly a 20% return (since late December), and now we need to add a new stock that is trading at a deep discount. I’ll unveil that name next week.

For now, you can sign up at our Charter Member price and take advantage of the massive upside of our value portfolio over the next 18 to 24 months.

A final item…

IN CASE YOU MISSED IT…

Starting around the middle of next week, WealthPress Hub will be coming to you under – and from – a new name: TradingPub.

You’ll still hear from me every day. And I’ll continue to send you popular articles from other top market experts.

I’ll tell you more about what you can expect on Monday.

To your wealth,

Garrett Baldwin

Market Momentum is Red

The S&P 500 tested the 4,000 level a few times today, but now we’re starting to see some level of choppiness ahead of the February jobs report. Investors should ignore all of this noise and focus on the long-term potential once the Fed finishes its rate hikes and turns its attention to stabilizing the economy. It all starts with our value and income plays over at Tactical Wealth Investor.