We’re at a critical juncture in the S&P 500.

With nine trading days remaining in February and plenty of economic jitters to go around, we could go up or down from here. Are you prepared?

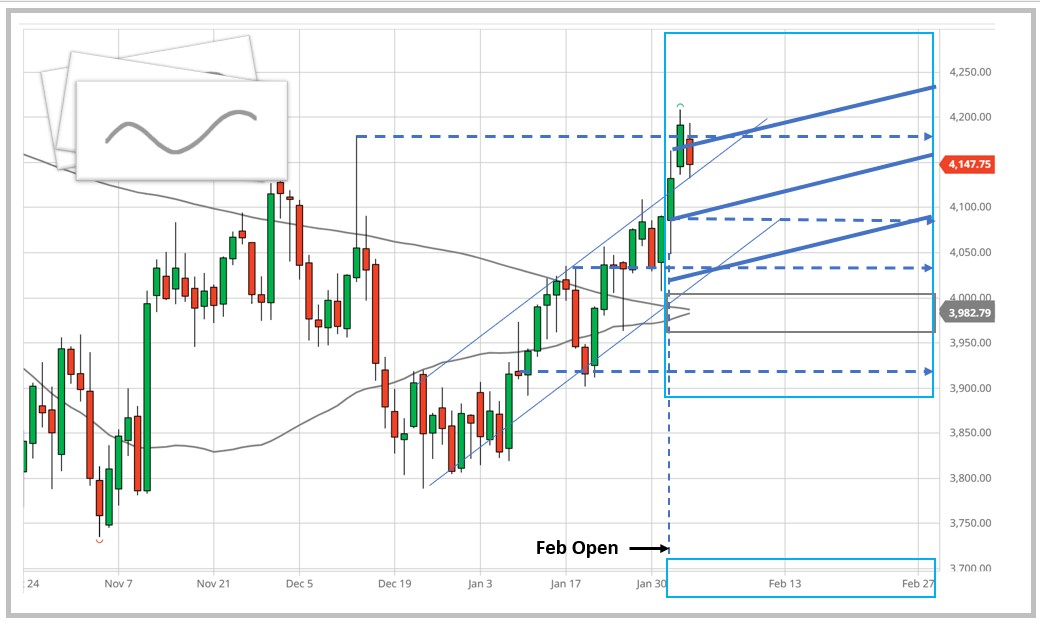

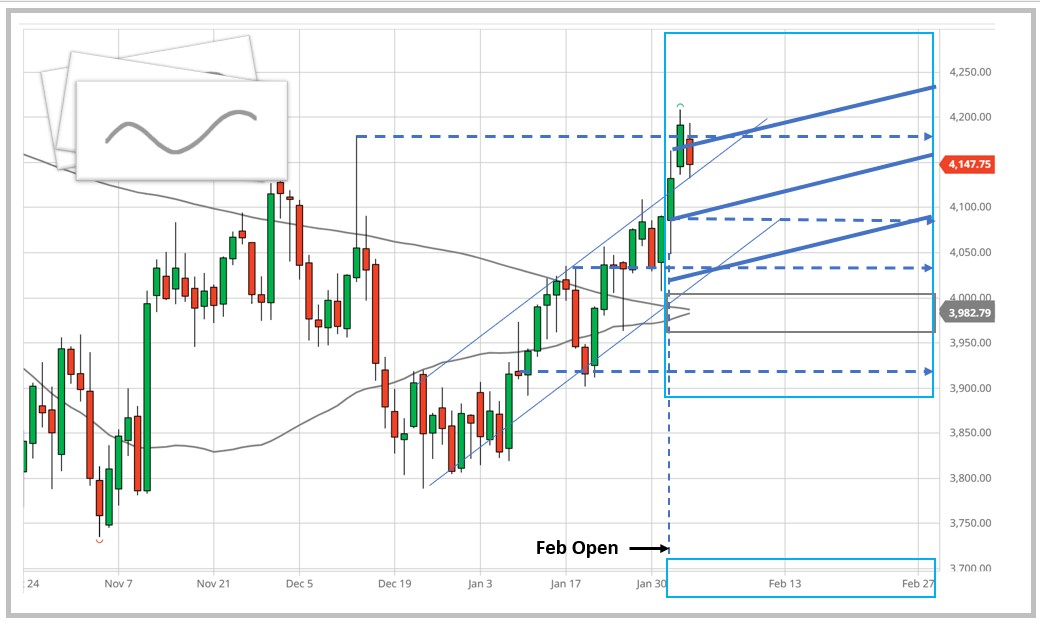

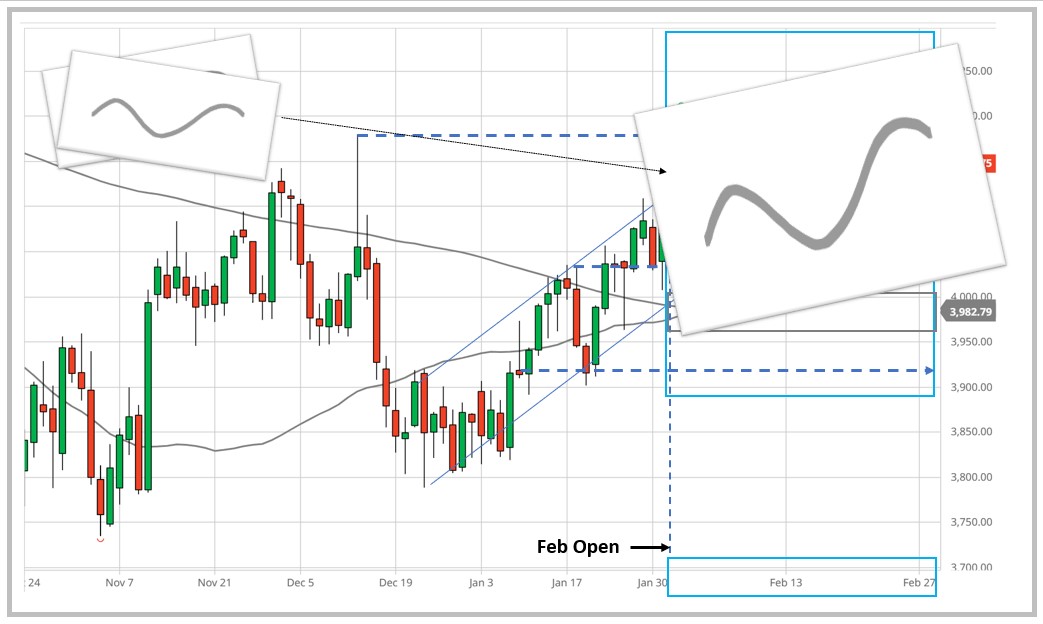

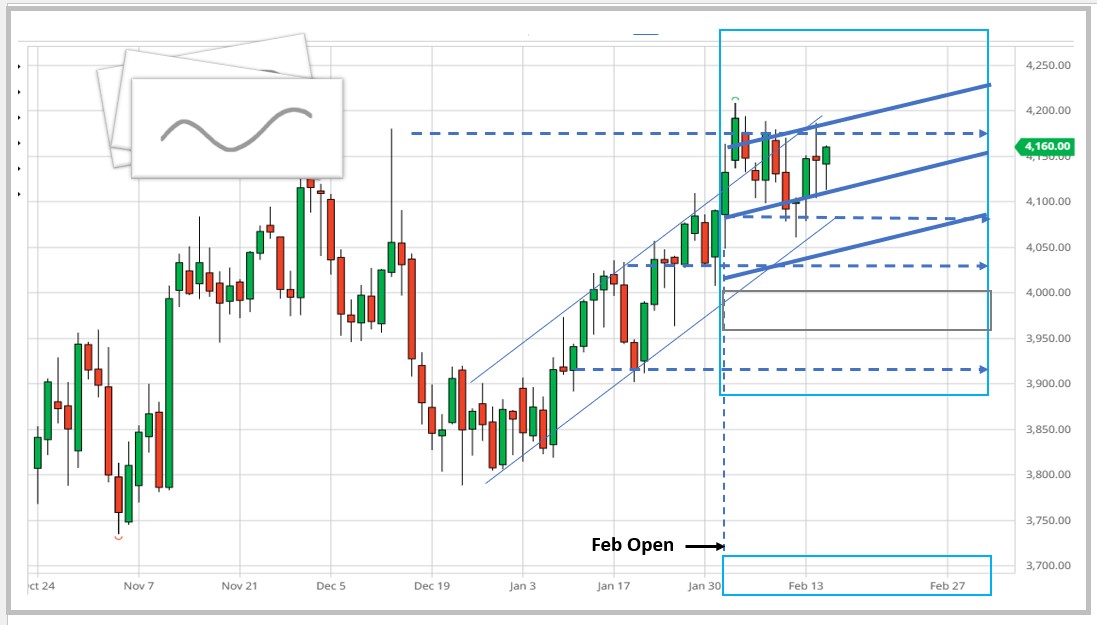

This daily chart of the S&P 500 futures shows the action for February, overlaid with my previously drawn black trend lines.

If you’ve seen my Telegram, you know this is how I projected the month:

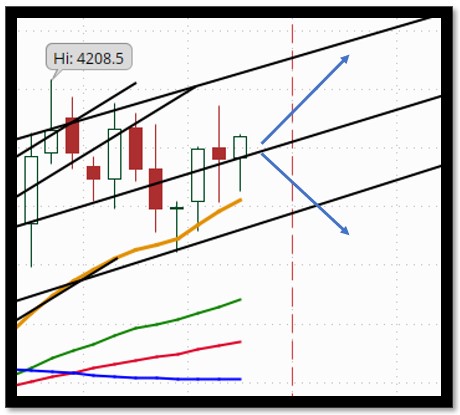

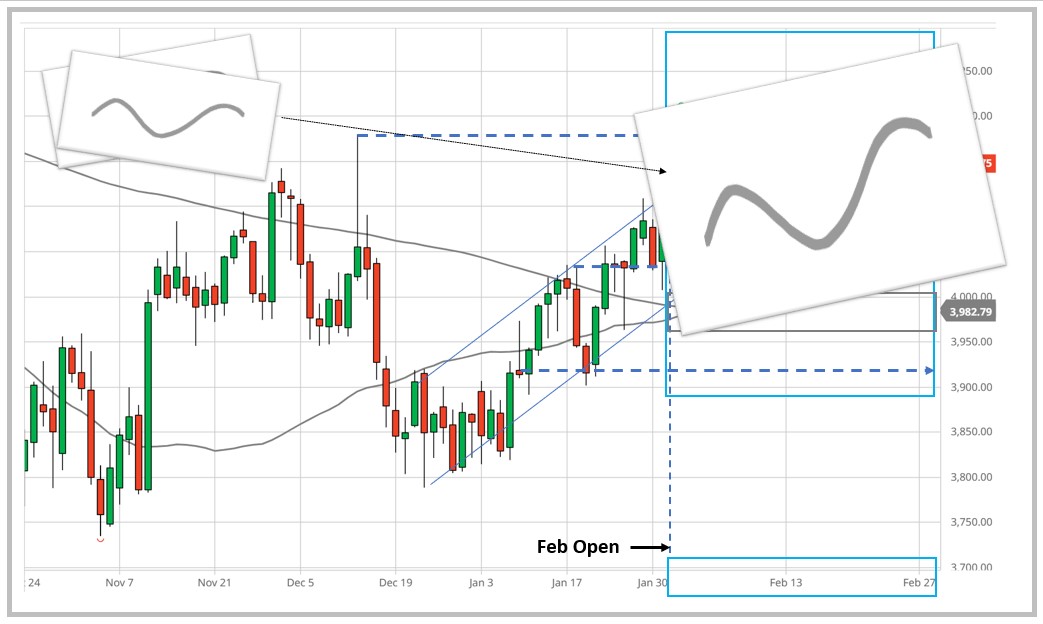

Here’s the movement I anticipated:

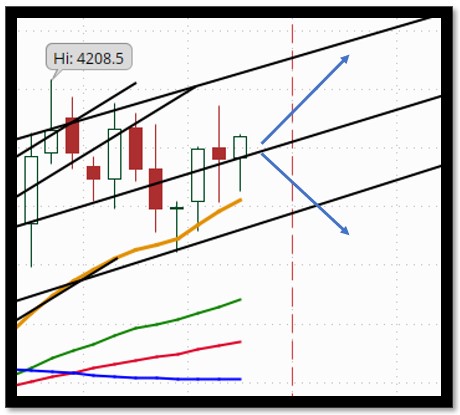

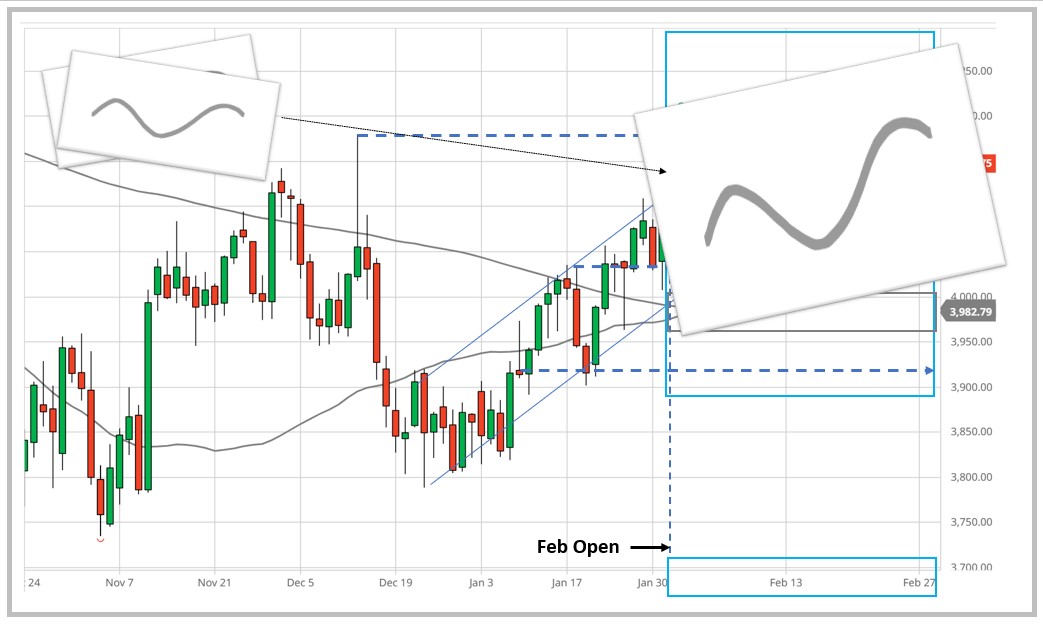

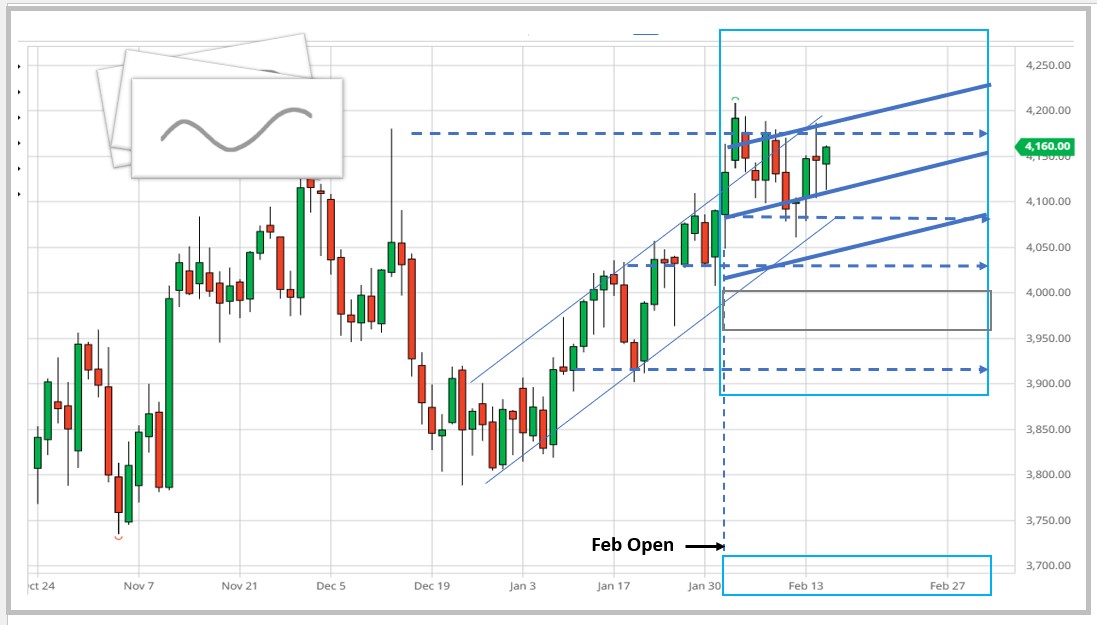

Here’s where we are now:

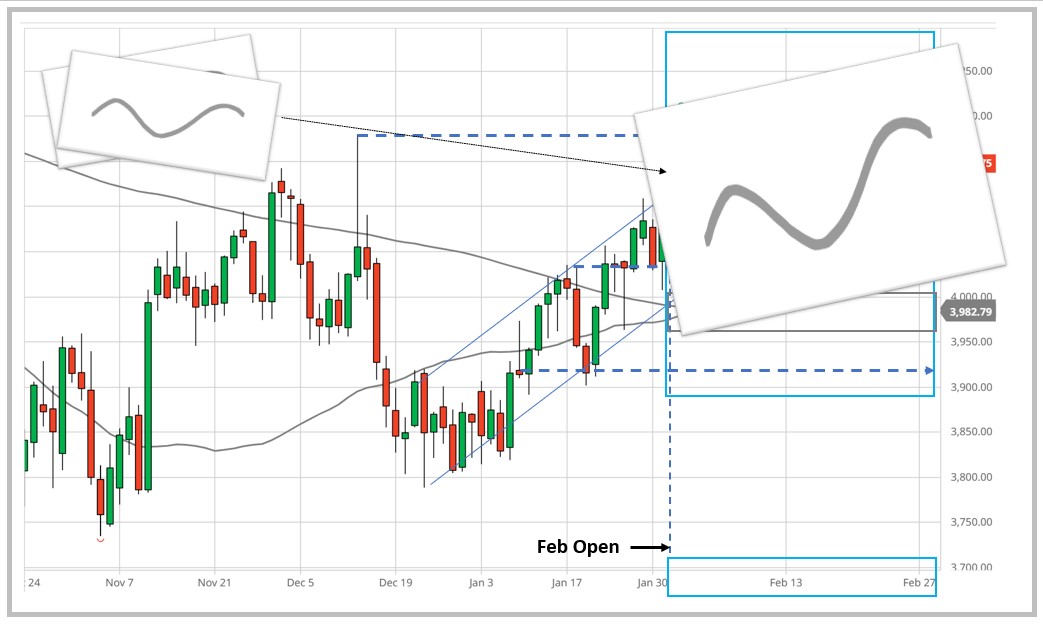

Critical Juncture for the S&P 500: Where February 2023 Could End

Being spot on is not the point. The point is using data to make money… Which is why we want to have an idea about where the S&P 500 is headed next.

The first option is we head down, and end the month down. If this happens, the first break is 4,067 area.

From there, it’s the 4,045, 4,033, 4,000 and 3,995 levels, for starters.

If February does indeed end the month down, the outlook for March is not so rosy, and this is the popular narrative at the moment.

Here’s the second option: We head sideways.

That’s the easy way out for now, so I’ll save that discussion for another time.

Finally, the third option is we head gingerly up, and end the month up. If this happens, historically, the facts point to a higher March — they just do.

I know this is opposite of what many well-grounded economic factors point to today. But at some point, less bad news prevails. It always does.

This time is not different … for either direction.

And I have to remain open-minded for many well-grounded reasons. And that means I have to be prepared for both the ups and downs, because they all will come.

At the end of the day, all I have to do is make money. That’s why I’m here, and I think that’s why you’re here, too!

So here’s how I do it…

- Trade with a plan that follows rules — long and short.

- Take what the market gives me.

- Put fear and greed in their place — the trash can.

Each step is a topic we’ll cover. For now, keep your head in the game — you were made for this!

Think and win!

Celeste Lindman

On the Go Investing

*This is for informational and educational purposes only. There is an inherent risk in trading, so trade at your own risk.

P.S. Prepare for 2023’s Make or Break Moment TODAY…

What New Money Crew Head Trader Lance Ippolito just uncovered could be devastating news to regular investors.

He’s seeing cash move out of many of the most widely held stocks at a pace you wouldn’t believe.

And he wants to show you WHY capital is leaving stocks, and WHERE it’s going so you can prepare NOW…

The bottom line is he expects this money transfer to crush buy-and-hold portfolios in the coming days…

That’s why you need to see the options available right now…

Including a new way to get out of stocks and into something far better… And far more effective for today’s conditions…

Look, the tides could turn in the coming days… And the aftermath could absolutely make or break investor wealth for the next decade or more.

You owe it to yourself to at least hear what Lance has to say.