The markets “tanked” Wednesday and are still struggling at print. “Ouch,” some may say…

Be Prepared

If you’ve read my Telegrams and newsletters and even listened to my colleagues on this week’s roundtable, you were not surprised.

We’ve said markets are overbought, and current price action reflects this.

Certainly, headlines and economic data come into play, but it’s both ironic and profitable when the market plays into a predictable pattern.

Make A Plan

What I’m talking about is constructing a hard right edge that’s laying a framework for what might happen next at the far right side of the chart.

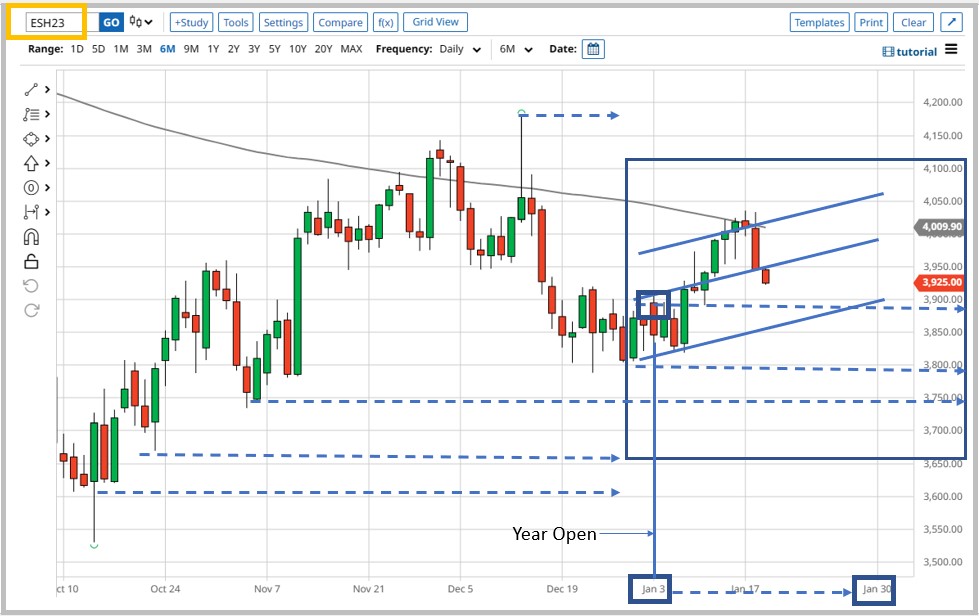

Here’s what I constructed on Jan. 10…

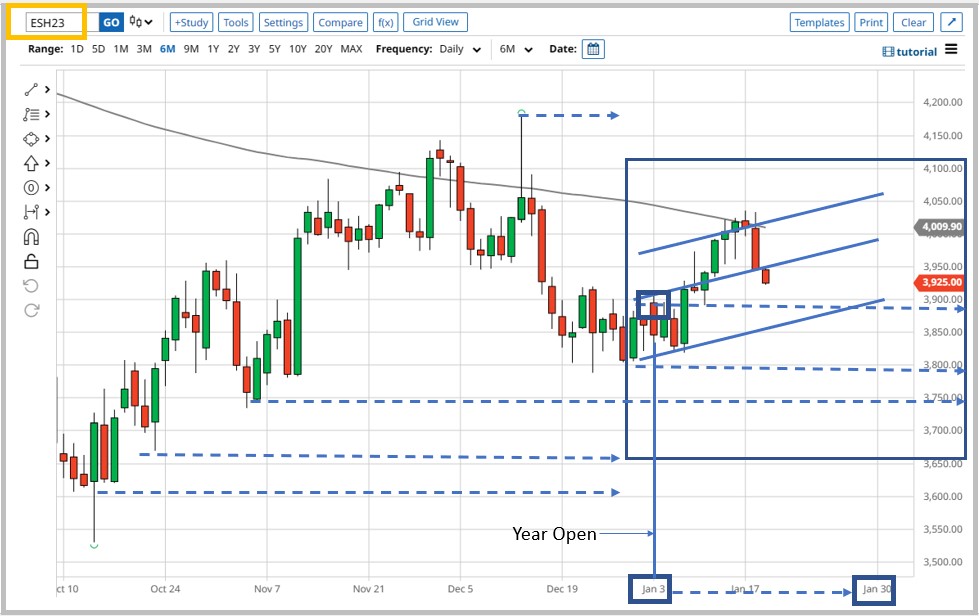

And here’s where we are now — it’s no accident…

What’s Next

My mind is open to the reality that price can approach any of the boxed levels in the days ahead before the close of January.

If price stays near the year and month open, traveling down as far as 3,800, the market has a solid chance of closing in the positive. If price penetrates the 3,750, 3,700 or 3,650 levels, then the bear just woke up again, in my opinion.

To me, the key is to watch all the levels inside the box above, which I base on Average True Range. This predetermined plan for price action gives me an edge and keeps me from being surprised or caught off guard.

Most importantly, it helps me make money and preserve capital.

I think it can help you, too.

Trade With A Sound Mind

I’m the first to say that markets do not move in straight lines, so be aware. However, the straight trend and support lines give order and direction to trading an unpredictable — and often volatile — future.

The market can trade wildly — with enormous volatility — if it wants. If it trades outside the box before the end of the month, that gives me a warning sign of a bigger, more important trend.

If it does this, I’ll be sure to write about it so you can be informed!

Here’s to your success!

Celeste Lindman

On the Go Investing

P.S. The Market Shift That’s Turned Stock Trading on its Head

There’s been a huge change in the markets lately.

You’ve probably felt it in your own trading.

It used to be that stock prices pushed around the direction of options prices…

But for the first time ever, we’re now seeing so many options contracts being traded… options are pushing around the underlying stocks!

It’s getting to the point where it may soon be more important to analyze options data than the stock itself to forecast potential opportunities…

And to be completely honest — this is a huge shift that most traders have no idea how to handle.

But Jack Carter has teamed up with Celeste Lindman to share a single, critical stock that could see huge upside from this major change.

And they just went live to share how you can get ahead of the curve and take advantage of this seismic shift.

Watch Their Presentation Here