Dear Reader,

Commodity prices have ripped in recent weeks, much to the surprise of dollar bulls.

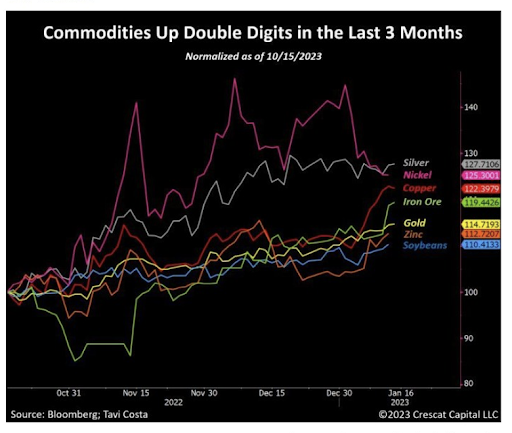

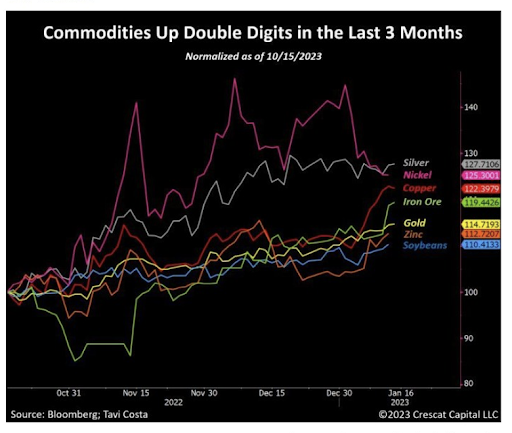

A weaker U.S. dollar supports everything – stocks, foreign currencies, and bond prices. But nowhere is this more evident than in the chart below.

Commodities are quietly on fire. Industrial metals like silver, nickel, and copper are up sharply since the markets bottomed out in September. These three metals are getting investor support on various macro-factors outside the dollar.

For what happens next, let’s look at the three other commodity bull factors that will drive prices in the year ahead, regardless of global recessionary fears.

Commodity Bull Factor No. 1: Russia and Ukraine

On Christmas Day, Reuters reported that Russian President Vladimir Putin was ready to negotiate around the War in Ukraine.

But all the chatter about negotiation is largely a ruse by Vladimir Putin to get through the cold winter.

Expect an escalation, especially if we start to see Ukraine moving forces anywhere near Sevastopol, Crimea… the home of Putin’s Black Sea Fleet.

Last week, the Wall Street Journal asked a question most Western diplomats don’t want to answer…

Is the West ready for a long war in Ukraine?

Putin is betting that the West will run out of steam – and maybe even capital – to keep this war going. Will American taxpayers really want to fund this war with billions of dollars as we push against our debt ceiling?

Will Europe be able to deal with the constant energy shocks?

Those are important questions. But more important is the reality of Russia. We tend to see Russia through a Western lens, which is our mistake.

Putin will continue to conscript soldiers. Russians will continue to desperately try to ignore the war in their backyard. And this could go on for years…

As a result, Russia’s oil will face sanctions. Food meant for the Middle East, and Northern Africa won’t make it there, placing a greater strain on the global agricultural markets. And a lot of metals for industrial purposes will go unmined or unsold.

This war’s possible escalation or ongoing deterioration will weigh on commodity supplies. The result is a world of elevated prices.

Commodity Bull Factor No. 2: China’s Reopening

As supplies remain the concern, we have to consider the demand side of the equation.

With global oil, supply is driven largely by OPEC policy. But demand growth is largely based on the actions of China’s growing economy.

The No. 2 economy in the world is coming back online after two years of COVID shutdowns. And most people don’t seem to understand just how dramatic China’s economic growth could be in 2023. We might see 5.5% to 6% growth in China as pent-up demand and government support of the housing market hits our focus.

Already, commodity prices are roaring on speculation around China. And we’re only three weeks into this process.

Despite concerns about a global slowdown, we must remember the things that matter: Food, energy, housing, and shipping. (Hello, Tactical Wealth Investor). So, it’s not surprising to see commodity prices get off the floor as China reopens.

We don’t need a massive turbocharge in commodity prices. We just need a heightened floor for commodity prices.

Goldman Sachs is already predicting that oil will hit $110 by the third quarter, thanks to China’s economy alone. I think that’s a bit too generous.

But a move to $85 to $90 for WTI will have a pronounced impact on energy producers, pipeline companies, and smart refinery companies that are hedging now. I believe the best course is to invest like oil will remain around $80 but speculate for higher prices.

The supply and demand equation suggests a tighter market on the back side of 2023.

Now is the time to take advantage.

Commodity Bull Factor No. 3: Supply Woes in the Agricultural Sector

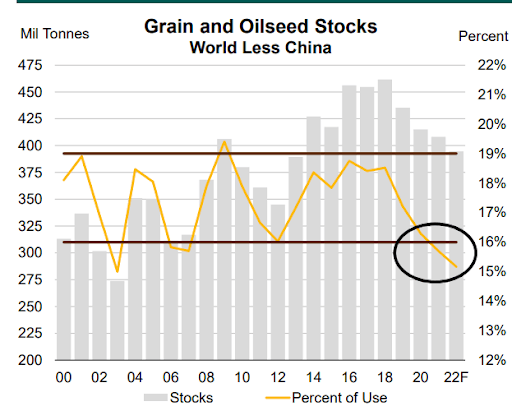

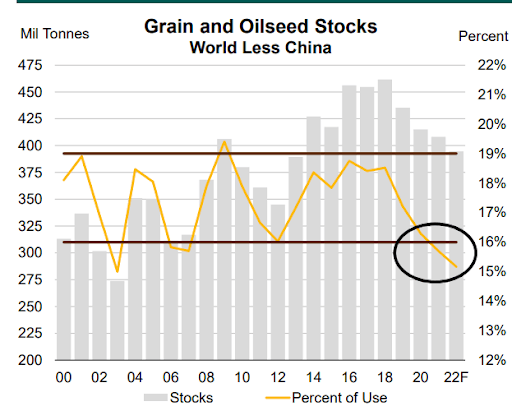

As we noted, industrial commodities are rising to start the year. Typically, energy and agricultural commodities would rise with other commodities. But we’ve seen a bit of a lag in that portion of the industry.

Across the U.S., we’ve been selling our existing (stored) food and fuel supplies.

The U.S. government has unloaded our Strategic Petroleum Reserve at a breakneck pace over the last 12 months. We’ll need to replenish this supply… eventually.

Meanwhile, on the agricultural side, farmers have been selling stocks (supply). We’re at the lowest level we’ve seen for stocks in 20 years.

This means that we could see a supply-demand imbalance in the months ahead. We’re approaching planting season in the Northern Hemisphere, and input costs remain elevated.

This is bullish for companies in the agricultural space – fertilizer, grain companies, and more.

I expect commodity prices to continue moving higher in the months ahead. Remember that the Fed will eventually pivot, which can propel commodity prices higher if demand returns to the global markets in a profound way. Invest in the stuff that matters.

I believe both food and energy will continue to see supply-demand imbalances in the year ahead.

To your wealth,

Garrett Baldwin

P.S. Please let me know if you have any feedback, questions about today’s issue or anything else. Just email us at [email protected].

*This is for informational and educational purposes only. There is an inherent risk in trading, so trade at your own risk.