The markets keep rallying despite the very clear warning that Federal Reserve Chairman Jerome Powell will offer to Congress this week.

Powell will testify for two days on the state of monetary policy and the economy. Given that less than 20% of Congressional members have any background in economics, I think the man is wasting his time.

Congress has been a cruel antagonist to the Fed’s efforts to reduce inflation in the nation. It authorized trillions in spending last year – with no clear path to sustainability.

In addition, the White House has really put the screws on the Fed in two ways…

First, the Treasury Department is pumping money into the system thanks to its “extraordinary circumstances” to avoid a national debt default.

Second, there’s no real supply-side solution to increasing the vital commodities that will likely be in shortage in the future: Food, energy, housing, and more.

This is an unserious group of bureaucrats who don’t live outside the Washington bubble.

Finally, the Fed faces other constraints from its colleagues in other nations. The Bank of Japan and the People’s Bank of China have provided ample liquidity to the global system.

There’s just one problem: Eventually this stuff will dry up.

What will the solution be? Probably more money printing.

But if that’s not possible, we’ll have another liquidity challenge ahead.

What’s Next

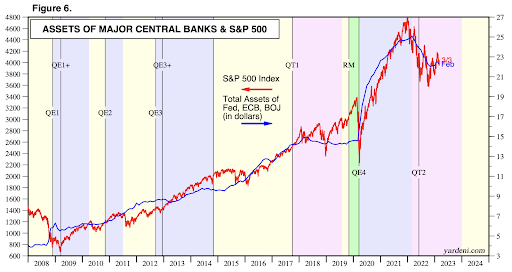

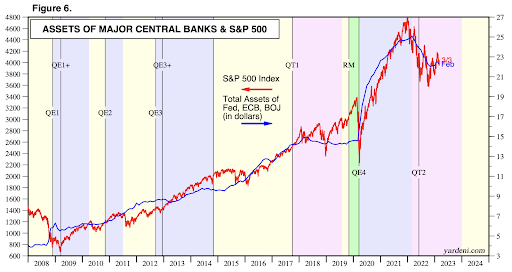

If you want to predict the direction of the S&P 500, just pay close attention to the balance sheets of central banks around the world.

As this chart from Yardeni Research shows, there is a direct causal relationship between central banks’ balance sheets and market performance.

Yet, as we can see, the markets quickly become addicted to cheap money.

The selloff of 2010 – after a massive round of liquidity – prompted the Fed to engage in another amplified round of Quantitative Easing.

Then came 2014, when central banks in Europe decided that austerity (the process of tightening one’s belt) wasn’t sustainable. So, they engaged in another huge uptick in asset purchases.

The result: Higher equity prices.

Finally, in 2020, the central banks dumped trillions more onto the system in a process known as QE4.

About 18 months later, however, inflation roared, and the banks had to start reducing their balance sheets. Surprising no one, the equity markets started to panic.

The markets bottomed in October 2022 after the tightening nearly sank the British economy. Since then, liquidity has expanded, central banks have loosened, and the equity markets have rebounded.

This can all run until… it stops.

The Fed Said What?

It’s fitting that over the weekend, I read a study by the San Francisco Federal Reserve Bank on the impact of loose financial conditions and the likelihood of financial crisis.

The February 2023 working paper is called Loose Monetary Policy and Financial Instability.

And what do you know? Here’s part of the summary:

“Are periods of persistently loose monetary policy more crisis-prone? This section argues that the answer to this question is in the affirmative. We see significant estimates in the medium term, that is around horizons of 5 to 10 years. Financial crises are predicted by loose monetary policy several years ahead.”

Simply put, long periods of low interest rates, cheap assets, and irrational exuberance create crises.

We’ve seen this happen multiple times over the last decade. It’s a real exploration into the “Alice in Wonderland” economic system that we’ve employed for the last two decades.

We had the Dot-Com bust, the 2009 crisis, the 2011 European crisis, the China crisis in 2015, the Fed tantrum in 2018, the Covid Bubble of 2020, and the market reaction to tightening in 2022.

This is not healthy…

Nor is it sustainable…

The paper concludes that “policymakers should take the dangers imposed by keeping policy rates low for long seriously, and thus weigh the potential short-run gains of loose monetary policy against potentially adverse medium-term consequences.”

Will they listen?

I doubt it. But it does tell us that more problems are ahead.

Even if the Fed does “pivot” and starts buying up assets all over again.

To your wealth,

Garrett Baldwin

Market Momentum is Green

Momentum turned positive last Thursday afternoon following the statement by Atlanta Fed Bank President Raphael Bostic. The central banker suggested that the Fed could pause on rate hikes. Well, now it’s clear that the central bank cannot pause on rate hikes. But enjoy the rally for now. We lifted our hedge position with the Proshares S&P 500 Short ETF (SPY) after momentum turned Green for the Tactical Wealth Investor. That’s incredibly bullish for the rest of our portfolio. Our January pick, Pangaea Logistics (PANL) is now up 29% since the start of the year.