Markets chopped on Wednesday after Fed Chair Jerome Powell testified before the House of Representatives on monetary policy and the economy.

As expected, Powell threw the markets a bone by stating that the Fed Open Market Committee is still debating between a 25-point or 50-point Fed Funds rate hike during its two-week meeting.

Powell’s appearance overshadowed another big development for the markets.

While everyone focused on a surprise drawdown on U.S. crude oil inventories (helping to push prices up), Warren Buffett’s Berkshire Hathaway (BRK.A) made headlines.

The conglomerate purchased another 5.8 million shares of Occidental Petroleum Company (OXY), boosting its holdings to roughly 22% of the stock.

Occidental is one of my favorite stocks to trade.

And today, I’ll show you one of my favorite options strategies to boost income, increase your chance of winning and the specific metrics that catch my attention. Let’s dive in.

Occidental Has a Steep Upside

Occidental is a major player in oil production in Texas. If you’re a baseball fan, prepare to see a lot of Occidental advertising on the jerseys of the World Series Champion Houston Astros.

The company got a pop this morning up to $63.50.

But with momentum weakening in the process, the stock has pulled back under $62.00 today. Occidental has an average price of $73.00 from Wall Street analysts with a larger upside of $84.00.

I think the upside is higher. I say $90.00, and it’s largely based on a very simple metric.

When the company’s debt gets back above Investment Grade, it’ll be a very attractive opportunity for institutions.

Occidental is right below Investment Grade, sitting at BB+. As the company continues to pay off its debt, increase its dividend, and buy back stock, it’s going to be even more attractive.

OXY currently has an F score of 7, but it’ll increase that figure due to buybacks in the future. In addition, it trades at a very low Enterprise Value to Earnings Before Interest and Tax (EV/EBIT) of 5.6x.

Its net margin is north of 36%, which is historically strong against the industry and its relative historical performance.

And then there’s Warren Buffett.

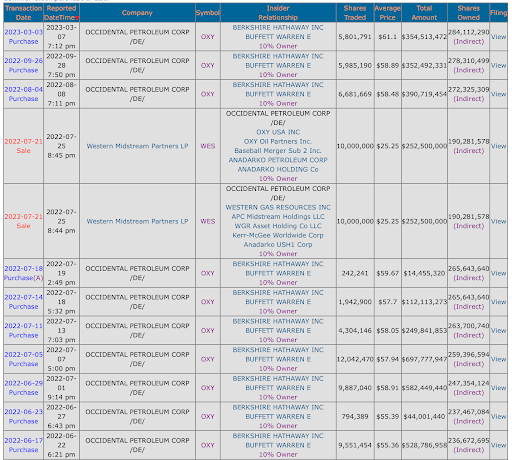

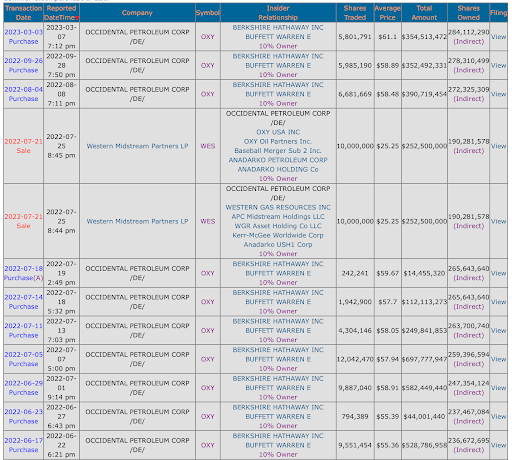

Berkshire Hathaway has permission from regulators to buy up to 50% of the company. Knowing how and where Buffett buys the stock is very important. Take a look at the chart below.

Occidental has been a terrific momentum stock in the last 15 months.

However, it bottomed out on three occasions in the last year.

First, during the massive hedge fund dump during June 2022.

Second, during the global liquidity challenges in October 2022 (thanks a lot, United Kingdom).

And third, a recent downturn linked to a lack of financial interest in oil from commodity traders due to recessionary concerns.

In each case… Buffett has bought the stock.

Berkshire isn’t buying up shares when the stock pops above $70.

Berkshire is stalking – waiting to buy OXY when it gets back around $60.

Here’s the recap of Berkshire’s buying activity over the last year…

You should follow this pattern as well.

How do I Trade OXY?

You could build a trove of OXY stock like Berkshire if you’d like, but there are better ways to trade it.

The best way is to sell a put spread on OXY in positive momentum conditions. So, when capital is flowing into the market – and the energy sector, I like to go back down into the $50s and sell spreads.

I start by going out 45 days on OXY and find an attractive price where I’d be content to own the stock. Given that Buffett has liked buying the stock around $58, I keep my eye on the $57.50 put.

If I sell that put, and the stock falls under that level, I’ll be assigned the stock. However, I am betting that it either won’t get to that level, or I’LL GLADLY buy the stock because it’s likely set to rebound (when Buffett likely makes another purchase).

Typically, if I’m selling a $57.50 put, I will need to put up a significant amount of margin. In the case of OXY, the April 21, 2023 $57.50 put costs about $1.37.

This means, I’d only generate about 2% on my return if I just sell a cash secured put. I’d also need about $5,613 in margin.

That’s not what I want.

So, I can buy the $55 put and protect myself in the process. If the stock falls under $55, the most I can lose is the margin between the $55 and $57.50 spread.

If I sold this spread, I’d require about $194 in margin to make $56 over the next 45 days. That’s a 28.9% return with a probability of profit of about 74%.

Now, this is strictly an educational trade. Why? Because momentum is negative. But if we go positive, and capital flows into the market, this would be a great trade for three reasons.

- If the stock goes up, the value of the spread goes down. As a result, we make money.

- If the stock just trades sideways, the value of the spread will decay. As a result, we’d make money.

- If momentum is positive and the stock pulls back, we’d be happy to own it at a lower level. But if momentum goes negative, we can just cut our losses and look for an opportunity to reenter this position.

Rather than expose ourselves to $6,100 in equity risk today, it’s really clean to trade these put spreads and seek optimal gains.

This trade itself offers an annualized return of 234% – meaning you can do this over and over again in the optimal conditions – and make nice gains on lower-risk strategies.

To your wealth,

Garrett Baldwin

P.S. Head’s up that change is a-coming to this WealthPress Hub free newsletter. We’re sprucing up with a new name and new look. I’ll be sending you more information on this in the coming days!

Market Momentum is Red

The S&P 500 tested the 4,000 level a few times today, but it’s finding resistance. These rejections have been sharp and swift, and investors need to pay close attention. When momentum is red, things can sell off quickly. These little rallies are designed to pull people back into the market so that funds can sell. Remember, the purpose of a market is to sell.