Yesterday’s market rally punched shorts incredibly hard in the face. It was such a decisive knockout that it will be hard for most of them to recover in 2023.

The AXS Short Innovation Daily ETF (SARK) – an inverse fund that bets against the stocks of Cathie Wood and her broken fundamental stocks – is off more than 28.5% to start the year.

Fed Chair Jerome Powell spoke at 2:30 pm yesterday, and in a period of roughly 11 minutes, the S&P 500 ETF (SPY) surged from 402 to 410.

The S&P 500 surged through its critical support level of 4,010.

Where did this rally originate?

The answer lies within the Fed. And it goes all the way back to January 3, just a few days before momentum turned green and this rally accelerated.

It’s a reminder that trading momentum without emotion is your best path forward.

Origins of a Fed Mistake

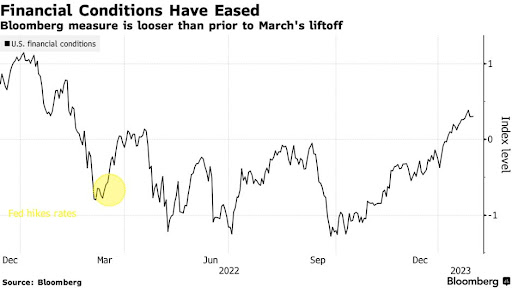

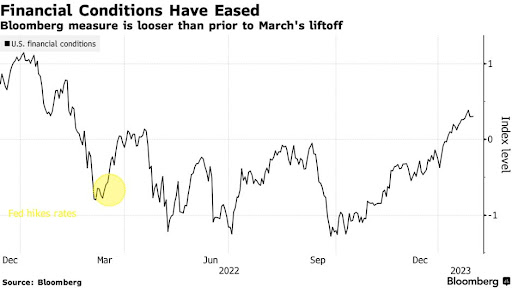

During the Fed’s December meeting, central bank officials realized they had a problem. Financial conditions had started to expand back in October.

According to the Chicago National Financial Conditions Index, investors were taking more risk, credit was increasing, and leverage was picking back up from the October bottom.

Here’s a chart from Bloomberg.

Minutes released on Wednesday, January 4, revealed concerns that the markets were pricing in disinflation too quickly. Fed officials said they were very worried that they couldn’t stop inflation if financial conditions kept expanding. They need higher interest rates to cool inflation through higher rates and or lowering stock prices.

Here’s the Wall Street Journal on January 4: “‘An unwarranted easing in financial conditions, especially if driven by a misperception by the public of’ how the Fed will react to economic developments ‘would complicate the committee’s effort to restore price stability,’ said minutes of the Fed’s Dec. 13-14 meeting.”

The reality is that financial conditions are expanding. They’ve been doing so for months. This is especially dangerous because we’re back in a position where liquidity is driving the markets and finding their way into riskier assets.

Powell Deflects the Most Important Question

Yesterday, Powell received a chance to address the expanding financial conditions head-on during the question and answer session. When confronted on the issue of expanding financial conditions – the very issue that plagued the Fed during its December meeting – he punted.

Powell said that he won’t comment on short-term financial conditions in the economy. That was all that traders needed to hear. Despite the eighth straight hike on interest rates – and signs of more to come – the market took the shorts to the woodshed.

Traders bid up Treasuries, corporate bonds and crypto. It was an onslaught of bids to the most heavily shorted stock. Carvana (CVNA) – a company that should be heading to bankruptcy court – has now seen its shares rally more than 100% on the year. In fact, shares popped another 22% overnight, after another 33% rally yesterday.

Meanwhile, nearly every signal in our economy is telling us that a recession is coming. Our manufacturing numbers are dismal. Our housing market is under strain. The bond markets remain inverted and waiting for a move lower.

The disconnect between our market and our economy is broken.

As I noted during our Roundtable session yesterday, liquidity is what matters. These financial conditions may quickly revert at any time, perhaps in the third quarter and once we have the Debt Ceiling resolved.

For now, the Fed seems to have lost control to stop asset price inflation – and that sets up for a very difficult next few months for logic to reign in these markets.

Financial conditions are expanding at the fastest pace since 2020, back when the YOLO trade ruled, and Meme stocks defied our imagination. For now, I encourage traders to focus on trading companies with strong annual earnings growth and price momentum. This will be a very unusual month.

Stay cautious, use stops, but remember that “Up is Down and Left is Shoe” for now.

Enjoy your day,

Garrett Baldwin

P.S. Please let me know if you have any feedback, questions about today’s issue or anything else. Just email us at [email protected].

*This is for informational and educational purposes only. There is an inherent risk in trading, so trade at your own risk.

Market Momentum is Green

Fed Chair Jerome Powell looked defeated as the risk-trade just shot through the key support levels. We now have a clear path toward 4,300 after the Fed effectively lost control of financial conditions in this economy. I believe this is setting up for a huge short opportunity on the horizon. However, the rally will need to sucker a lot of people back into this market and shorts will need to admit defeat for now.