Before we get started, be sure to join my Telegram channel to get a notification whenever I post a new article and other trading info, resources and goodies!

Now, about improving your trading results…

The S&P 500 just finished a historic first month of gains. Maybe your results were better than you expected, or maybe your results have you feeling left in the dust.

Professional traders always work to hone their skills, regardless. Here are some ways you can, too…

Know The Way

Have an idea as to where the broader market can go over a designated time frame.

At the beginning of last month, I posted my projection for January…

And here’s how it finished…

Having this framework helped me make money. Understanding news events, trends and cycles are a few keys I used. Applying these components and others in your own way might help you improve your trading success.

Keep in mind that markets can go higher than you think, lower than you think, and sideways for longer than you think.

Just because a market is oversold, overbought or over the hill doesn’t mean it can’t go into overdrive.

Know the Main Drivers

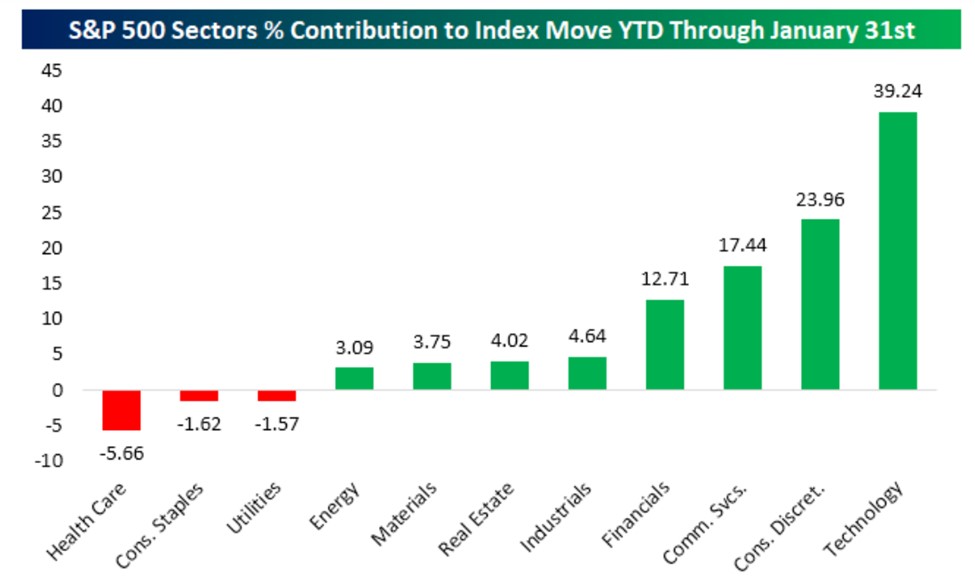

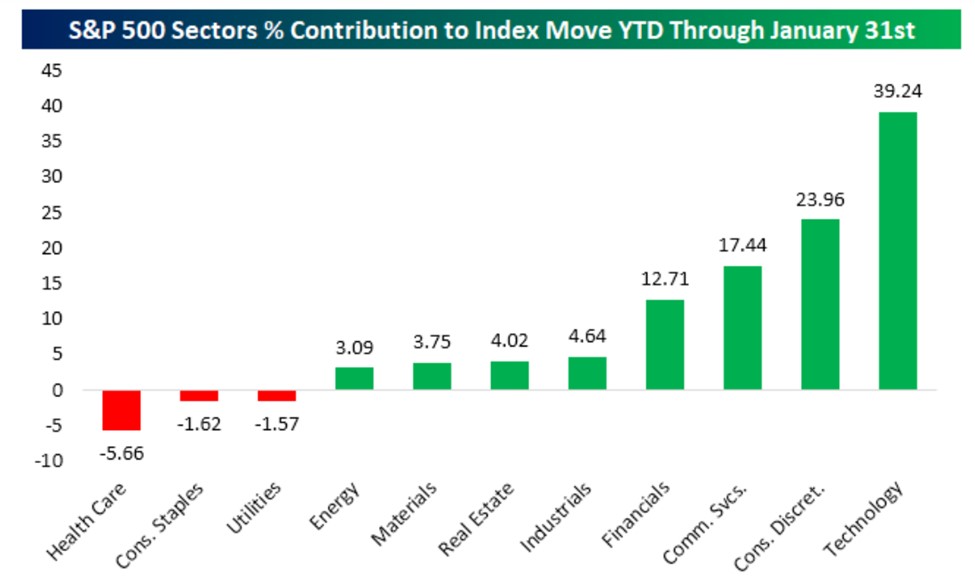

Study the 11 sectors of the S&P 500, and understand which ones are strong and which ones are weak.

The evidence is in! The Information Technology sector took control of January, followed by Consumer Discretionary and Communication Services. Health Care, Consumer Staples, and Utilities all lagged.

Could it be that the economic news is becoming less bad and we’re starting the climb out of the recession? (Yes, I’m on record saying that in the months ahead we’ll get notice that “the U.S. has been in a recession”).

Or maybe the Tech sector and its buddies are just having a dead cat bounce.

Either or both are possible.

According to Bespoke, just 10 stocks in the top 3 sectors contributed 49.49% of the 230 points gained by the S&P 500 in January! I bet you can guess at least five in five seconds…

But just in case, here they are…

- Apple Inc. (Nasdaq: AAPL).

- Amazon.com Inc. (Nasdaq: AMZN)

- Tesla Inc. (Nasdaq: TSLA).

- Nvidia Corp. (Nasdaq: NVDA).

- Meta Platforms Inc. (Nasdaq: META).

- Alphabet Inc. Class C (Nasdaq: GOOG).

- Alphabet Inc. Class A (Nasdaq: GOOGL).

- Microsoft Corp. (Nasdaq: MSFT).

- Walt Disney Co. (NYSE: DIS).

- Visa Inc. (NYSE: V).

Looking at Health Care, Consumer Staples and Utilities, could they be the winners of February, or will their carnage get worse?

The point is this: Understanding keys about sectors helps traders make cents in stocks, and that’s the next topic.

Know The Players

Start each day, week or month with a stock watch list.

Eli Lilly and Co. (NYSE: LLY) was one of my favorite stocks for 2022. I’m watching for a pullback to time my next entry because I still like its fundamentals. It might not come in 2023 — after all, a lot of insiders took profits last quarter. But I’m still watching.

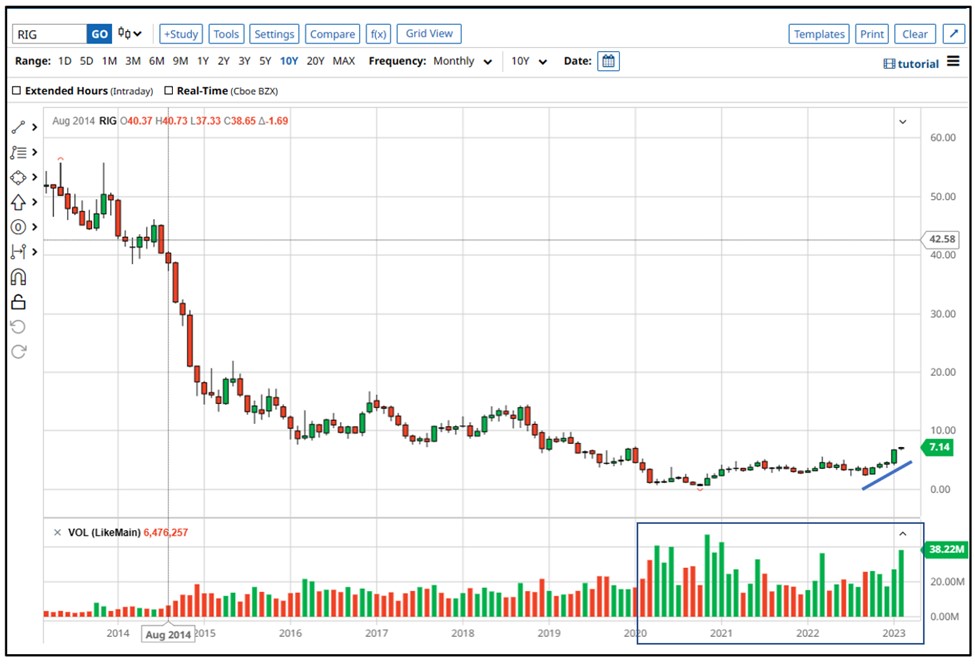

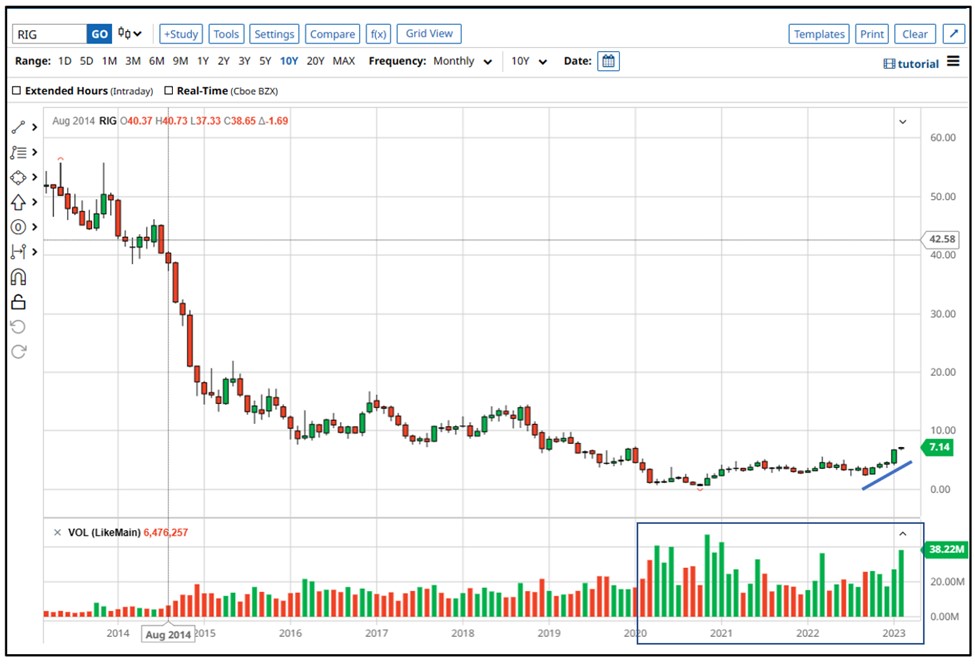

Transocean Ltd. (NYSE: RIG), in the Energy sector… now there’s a dog! That’s an ugly 10-year chart if I ever saw one.

Oh by the way, insiders massively bought this stock last year, and check out the volume on the bottom right.

If you’re serious about trading and improving your results, look at a daily chart to get a different picture. Is there an opportunity? Maybe, maybe not… But someone is buying.

Here’s what I find interesting: Although just 10 mega-cap stocks in just three sectors have taken control since the first of the year, a large number of smaller-cap stocks contributed more than their fair share to the January plunder.

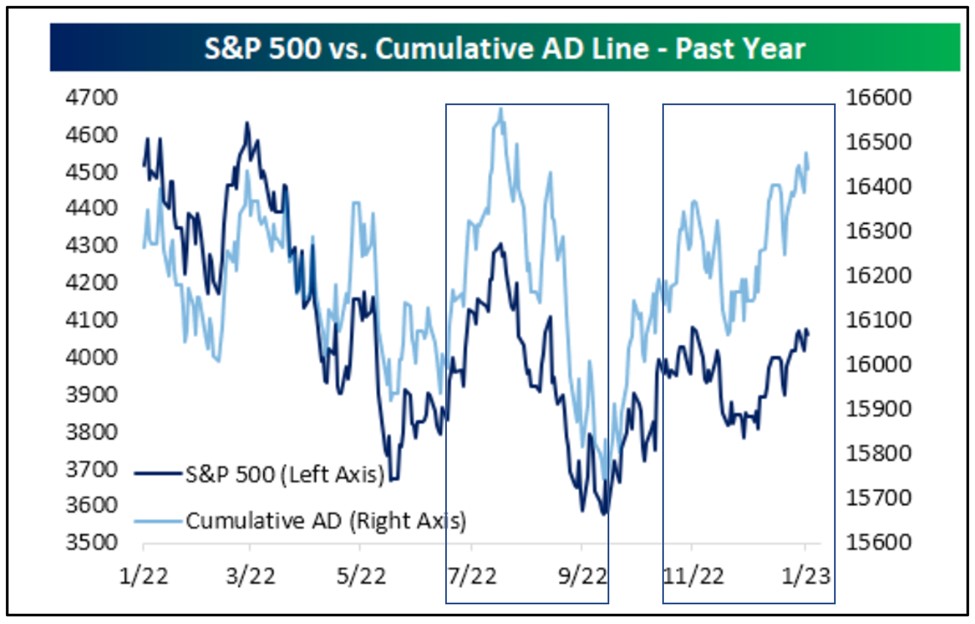

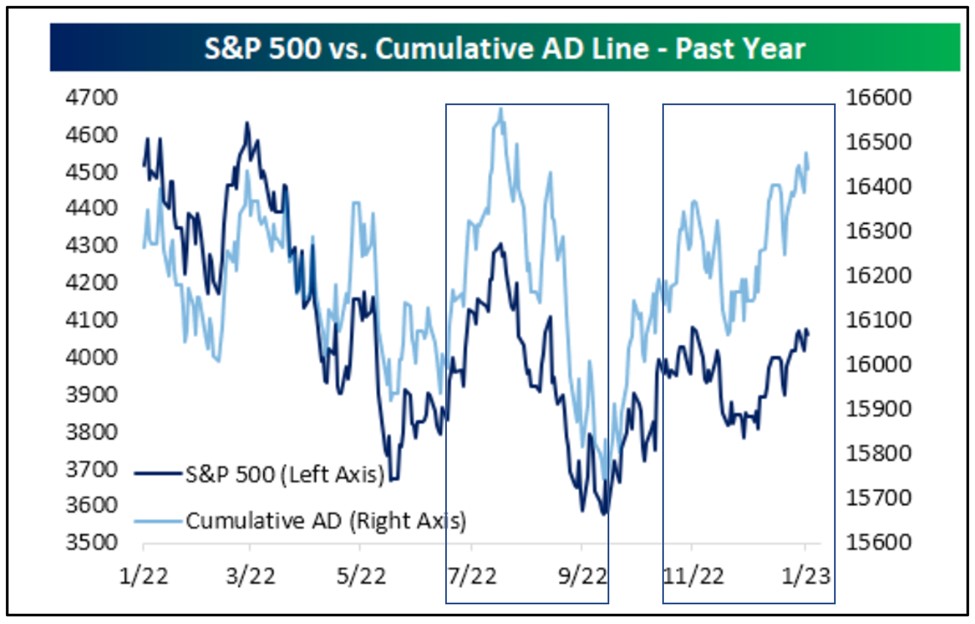

You can see this in the Cumulative AD Line (light blue) overpowering the S&P 500’s dark blue line.

Compare what’s happening now — November 2022 through January 2023 — to what happened July through September 2022. How are they the same, how are they different, how can you use this information to become a better trader?

Think and win!

Celeste Lindman

On the Go Investing

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.