Being open-minded for a positive February and first quarter with no retest of the market’s October low seems prudent based on the research. This is not the common narrative, but it is the common history.

With positive rallies during the last week of December, the first week of January, and the entire month of January — a “trifecta” per the “Stock Trader’s Almanac” — the research far beyond STA points to quite a positive year.

That doesn’t mean it will happen. It just means traders should be open-minded and ready for whatever the market gives.

February Wants To Be Your Valentine

The second month of the new year is a bit all over the place seasonally…

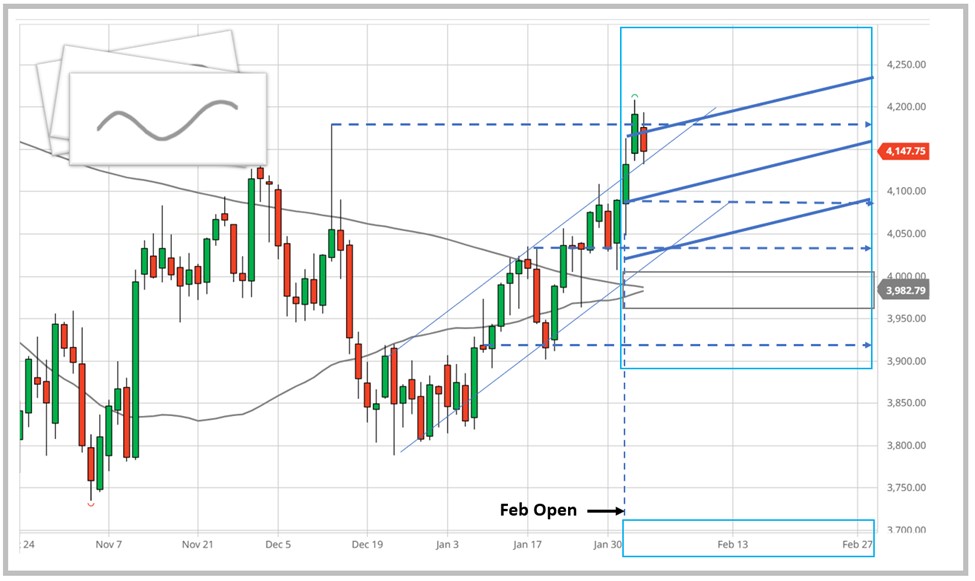

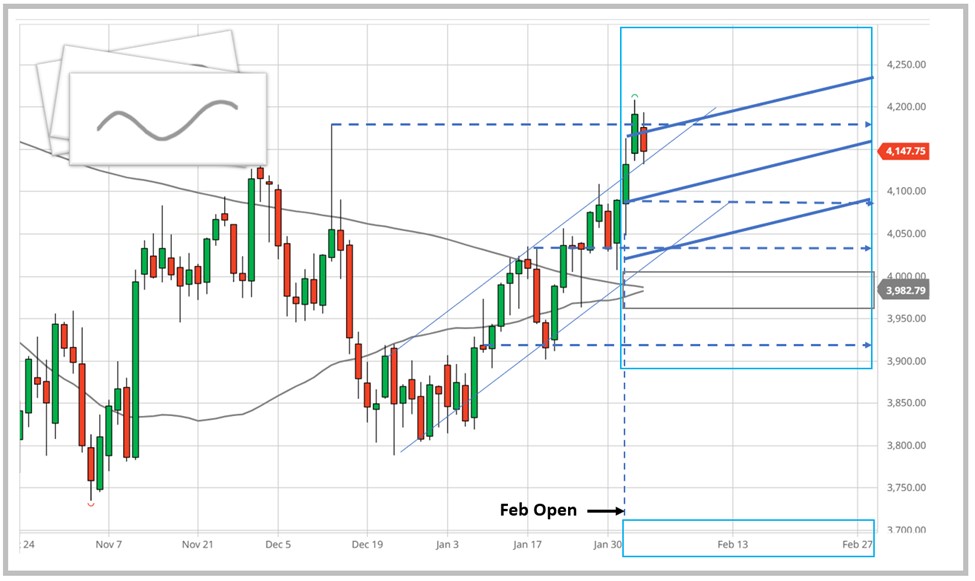

Nonetheless, putting it together with a variety of pieces and parts from the economy and the past, the direction points upward for February, which also points to an upward bias in March. Yes, you read that correctly.

Just how far up? Here’s my take on it and my “Hard Right Edge” and my February 2023 market outlook.

But not so fast. Keep this in mind…

- Anything can happen.

- Markets can go higher than anyone thinks.

- Markets can go lower than anyone thinks.

- No one has a functioning crystal ball.

News And Glitches That Move

On the flip side, if February closes strongly to the downside after the recent December and January move up in price action, then thoughts on a solid Q1 or year must be reconsidered. In other words, the trend in place from October would need to be reevaluated.

What could cause a move? News events.

They inflict moments of pain and joy in price action every month.

Here’s my euphemism… Wherever the market goes, that’s where it intended to go.

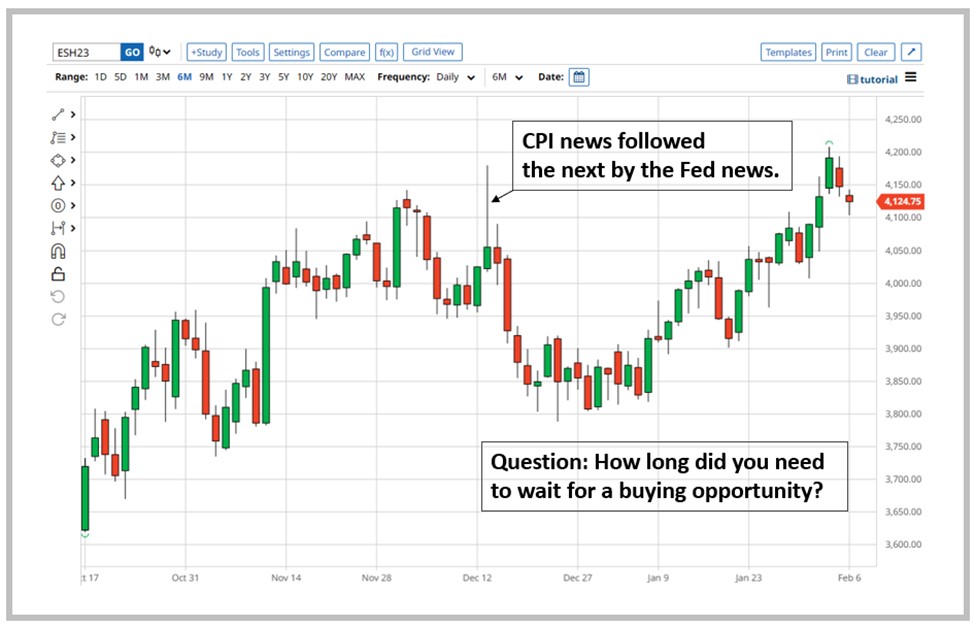

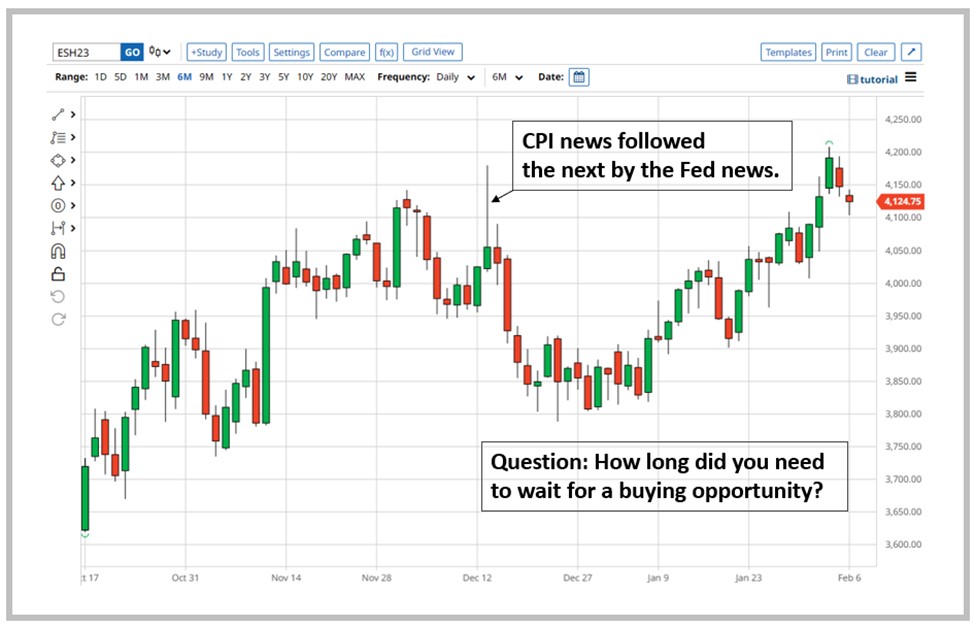

Remember this on Dec. 13?

How about this unexpected event on Jan. 24?

The glitch had this impact on over 250 stocks:

The natural response is for me to say, “Hey, NYSE, I’m not buying it!” But that would not be true…

That’s because some professional accumulation just stepped in the last few trading days. I wonder how long I’ll have to wait for a carefully timed “buy” to pay off, or where it will go?

Dating February

Regardless of my euphemism and other useless-isms about the market, here are a few news dates to remember.

Retail Sales, Consumer Price Index and Producer Price Index reports all come the week of Feb. 14, along with monthly options expiration.

Federal Open Market Committee Meeting Minutes, GDP and housing data debut the week of Feb. 21 after the President’s Day holiday on Feb. 20.

The last day, Feb. 28, is seasonally slightly down. Maybe it’s because seven news events are scheduled.

More Trends And Bends: Be On The Lookout

Watch tech, tracked by the Invesco QQQ Trust Series 1 (Nasdaq: QQQ), and small caps, tracked by the iShares Russell 2000 ETF (NYSEArca: IWM), this month. Their continued strength supports quite the positive year narrative — regardless of what the 2023 minds think about either. This is further emphasized if February is positive.

Keep an eye on global markets. They started the rally in Q3 2022. Will they pull back for buying opportunities, keep going or end the current trend and no longer be called “friend”?

Don’t lose sight of the Nasdaq low on Dec. 28. A break of near- or short-term support areas could imply that January’s rally in the S&P 500 is just fool’s gold.

Finally, the Dow and Utilities, Consumer Staples and Health Care sectors will have my attention, partially to see what they do and greedily to see if there is opportunity.

That is until some other sector starts capturing my short attention span with its pretty flashing lights saying “Buy me! Buy me!”

If it does, I’ll let you know!

Think and Win!

Celeste Lindman

On the Go Investing

P.S. Be sure and join my Telegram channel for all of my latest market updates and other goodies!