Dear Reader,

Good news… We can’t be in a recession ever again.

Our moral betters have decided it. If you see economic data clearly pointing to an economic slowdown, you’re not a “serious economist.”

We now live in a world that rivals Alice in Wonderland… or even 1984.

It just depends if you prefer watching cartoons or “a boot stamping on a human face – forever,” as Orwell wrote. Apologies for that image. But I just can’t take half the stuff coming out of Washington seriously.

We’re in the middle of a financial crisis, but we’re not acting like it. And while I personally think that Federal Reserve Chair Jerome Powell is doing a pretty good job, the economic wizardry of our moral betters in Congress will undercut the man’s work, and he’ll be held responsible for it.

Let me show you what has me worried about this market and why I’m eyeing next week’s data as a possible profit-taking event that turns this market lower.

The Most Important Chart in Economics

Eric Basmajian is a smart, young guy. Well, young to me. He went to NYU and studied economics, then started moving up the ranks in New York finance and decided to just start his own research company.

He’s one of the 15 people I pay attention to… because he’s willing to tell people the truth about the state of the economy… just like me.

He created a very important chart in U.S. macroeconomics.

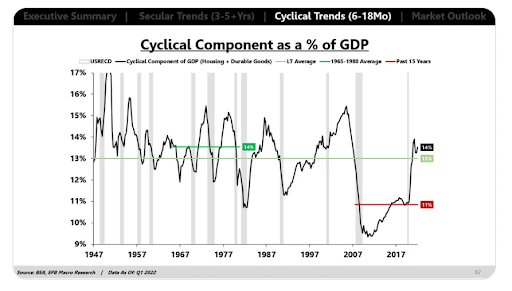

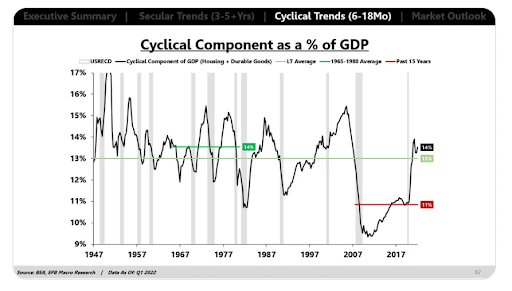

This is a measurement of cyclical spending against a nation’s gross domestic product (GDP).

What you have here is a deep, glaring look into the economy. The cyclical component of our economy is effectively just housing and durable goods.

It’s 10% to 15% of GDP, but as this chart shows, there’s dramatic movement whether we experience growth or recession.

Now let me show you a different chart, one that should make you jump out of your chair.

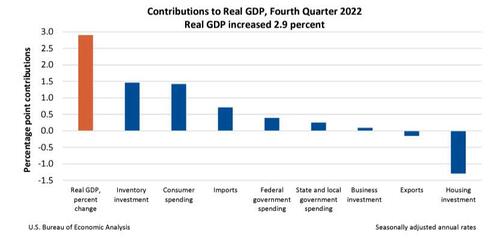

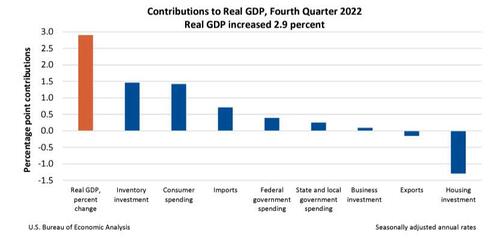

Here are the contributions to GDP in the fourth quarter. Everyone is high fiving saying that we have great economic growth.

But look at three things…

First, inventory management surged. We produced a lot of goods, and we now have them in our inventory. If consumer demand slows down and we experience a deflationary cycle, which is what’s happening, then this will hurt manufacturing even more.

Second, look at housing investment. That critical component has been blown out of the water. The Fed offered support to the housing market back in November when it stopped dumping mortgage-backed securities. But if we think that housing will recover in the next eight months, then we need to start day drinking. Because that’s just not going to happen.

Finally, look at consumer spending. It’s still elevated.

Why?

Because, as I continue to argue, negative real interest rates – the Consumer Price Index minus the Fed’s Fund Rate – encourages consumers to spend. Who’s actually getting 3.5% from their bank right now? No one, unless they’re locking in one-year CDs.

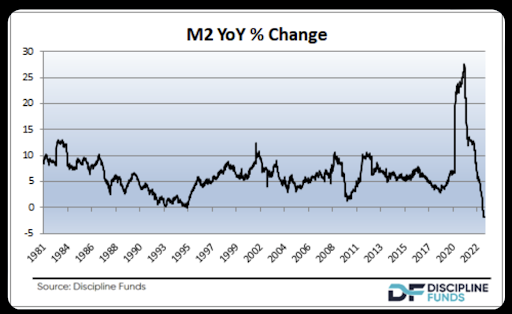

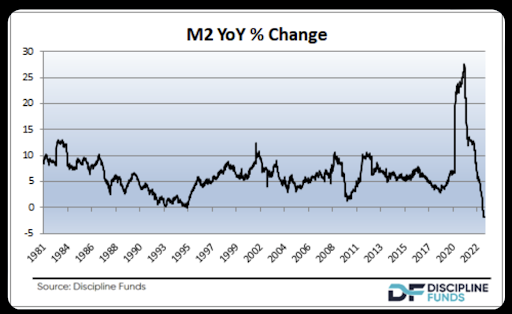

And that’s critical because the entire financial system is moving into a deflationary situation. The M2 – which is a major indicator of “future inflation” and economic growth expectations – has collapsed at a pace we haven’t seen since the Great Depression.

This is our money supply. This is a complete cratering of our aggregate demand in our economy. And the Fed is still tightening.

So, let me make this easy for you – something big is coming. It could be next week. It could be in the March meeting.

And we’re now moving into an elevated environment where stock multiples are being squeezed higher in an economy that doesn’t justify it.

I think there’s a strong chance that a recession has started – no matter how much money Congress keeps throwing at the wall.

In fact, Congress is making it worse because if the Fed starts to cut, there’s a strong chance that inflation roars back. And then we’re in a much worse situation than we were a year ago.

That’s why I’m buying energy, shipping… the things we need, not the things we want.

What Will a Selloff Look Like?

Look back to June 8 of last year. That negative momentum selloff was the strongest in 15 years. I called it down to the hour.

You need to know when to get out of the way if the algos and the funds decide to take profits from the 6% bounce we’ve seen since the start of the year.

Don’t be the person without a chair when the music stops.

Check back with me, I’ll let you know when momentum turns negative…

To your wealth,

Garrett Baldwin

P.S. Please let me know if you have any feedback, questions about today’s issue or anything else. Just email us at hubfeedback@wealthpress.com.

*This is for informational and educational purposes only. There is an inherent risk in trading, so trade at your own risk.

Market Momentum is Green

The music is playing, and we’re still dancing. But the technicals are telling me that we’re getting into very frothy territory. I’m not shorting anything, but I’m not trying to buy up anything significant right now. Next week could deliver some fireworks, and I’m a big fan of taking some profits as they arrive. I’ll discuss how I plan to hedge this market on Friday.