Dear Reader,

Shakespeare once wrote:

Gonna get rowdy

Gonna get a little unruly

Get it fired up in a hurry

Wanna get dirty…

I’m sorry.

No. That was Christina Aguilera.

I get the two confused all the time.

I’m the type of guy who is trying to get his carbon footprint higher – largely because I never leave the house.

So when I think about the global energy crisis, I see a clear trend in “dirty” energy. After Europe failed to generate enough wind and solar power to keep its lights on, the continent has turned to the dirtiest form of energy: Coal.

And that has created an amazing opportunity for both value and income.

Let’s get dirty…

Holy Coaly

There are plenty of ways to buy into the ongoing energy trend. Coal demand is thriving, and it’s not going away any time soon.

In fact, one of my favorite coal energy stocks just blew the doors off in its latest earnings report. Shares of Alliance Resource Partners (ARLP) popped 11% on Monday after the company reported earnings.

The numbers were huge.

Take a look at this. From Yahoo! Finance:

- Fourth quarter 2022 revenue of $700.7 million, net income of $214.5 million, and EBITDA of $293.9 million, up 48.0%, 313.8%, and 125.7%, respectively, year-over-year

- Record full year 2022 revenue of $2.4 billion, net income of $577.2 million, and EBITDA of $940.2 million, up 53.3%, 224.0%, and 96.3%, respectively, year-over-year

Those numbers are just the appetizer. And of course, those numbers are incredible. The fact that income and EBITDA have surged – and profitability – is amazing. As a result, this company is sitting on an immense amount of cash, which led to these additional benefits for shareholders.

The company also increased its dividend by 40%.

It boosted its buyback program to $100 million.

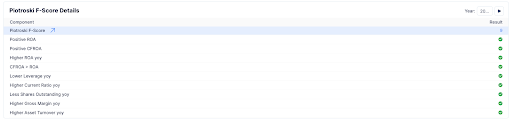

And… its F score is 9. That’s perfect.

Everything you want out of management is right here in this chart:

coal stocks

The company can’t do anything but react to public policy. Politicians want coal to die… yet rely on it more than ever. And these companies aren’t expanding production. They’re just giving the money right back to shareholders in a responsible manner.

When you own stocks with an F score of 9 and the company surprises to the upside, that means that the money is coming directly back to shareholders. I love… love… love that.

But

Coal isn’t going to last forever. Politicians want it dead. There’s good reason to own ARLP over the last year for the dividend and upside.

But let me do one better…

Tactical Wealth Investor owns one stock that is actually down in January, and that’s a reason for me to buy more. This “coal” stock operates in mining, and it owns an immense amount of the dirty stuff.

It also, however, is the company behind the single largest lithium mining operation for the next decade. And this stock trades at an immense discount because of very silly market expectations about coal.

The stock has an F score of 7 (great), an Altman Z Score of 3.4, and trades at a Price-to-Graham ratio of just 0.35x. So, owning just four shares of this stock would pay for a Tactical Wealth Investor subscription if the stock moves from $35 to its fair value of $45 in the next few months.

Win win.

To your wealth,

Garrett Baldwin

P.S. Please let me know if you have any feedback, questions about today’s issue or anything else. Just email us at hubfeedback@wealthpress.com.

*This is for informational and educational purposes only. There is an inherent risk in trading, so trade at your own risk.

Market Momentum is Green

The market is in a very tough window right now. I’m taking gains off the January 6 momentum switch and waiting until the Fed event. This is a weird environment where we could move to 3,400… or 4,300 on the S&P 500. I’ll discuss more during Wednesday’s Roundtable with Don Yocham. You can join me right here at 10am ET. It’s free!