The 600-pound Gorilla in the room is the inverted 10-year/two-year bond reading.

For 40 years, there has never been a false signal about whether the U.S. economy is heading into a recession. We’re extremely inverted.

I’ve noted that the most productive parts of our economy are under stress. Housing and durable goods readings for the fourth quarter were ugly.

Yesterday’s durable goods numbers showed a 4.5% drop in January. Housing benefited from lower rates in January, but the market has quickly reversed and pressed mortgage rates back above 7%.

I don’t think that February will look any better.

But there’s another monster in the corner. A Godzilla…

And this one could fuel a twin-set of problems for the economy in Q3.

Let’s dig in.

Will Rates Go to… 6%

A few weeks ago, CNBC interrupted a guest for suggesting that the Fed funds rate may need to move to 6%. The general argument was that this fund manager was simply instilling fear in the market to drive a narrative for his firm.

Well… it’s funny how narratives can shift rather quickly. In fact, we’re now seeing some lofty bets that the Fed funds rate will hit 6% this year.

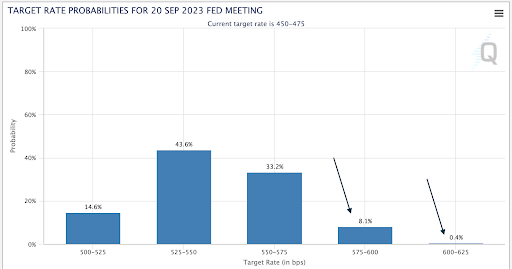

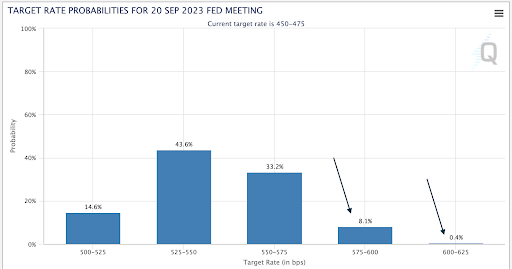

CME Fed Watch shows there’s an 8.1% chance that we’re at the upward bound of 6% by the September 20 Fed meeting, and a 0.4% chance that we puncture that level.

What’s happening? I thought we were only going to 4.5%, right?

Well, financial conditions continue to loosen around the globe, bringing a wave of capital into risk assets – especially equities. In addition, it helps fuel consumer spending (flush with credit).

Remember: “Inflation is Transitory?”

Well, keep in mind that the Fed was pumping money into the system in 2021 while pushing that narrative.

Now, it’s the ECB, Bank of Japan, Peoples Bank of China, and other central banks. All the while, the Treasury Department is providing liquidity to the system to prevent a default on U.S. debt.

The result is a mess. We’re raising interest rates on the productive parts of our economy, while we goose the others to promote GDP for political gain.

Want to keep American out of a recession? Just sell a ton of U.S. oil from the Strategic Petroleum Reserve. That’s how we kept things elevated in Q3 2022.

We’re selling a lot more this quarter. Why?

Meanwhile, the government doesn’t really care about debt. But consumers and businesses have to.

Government will always view things through the lens that money is free and stimulative. We know that’s counterintuitive.

The Federal Reserve is fighting inflation by itself. As financial conditions loosen, it’s not surprising to see inflation remain sticky. So, the Fed might have to go even higher.

The Fed isn’t very happy about the big move in the stock market. When the market moves higher, investors think they have more money, so they are inclined to spend more now. That is inflationary on the surface.

In addition, the very idea that people will pay more money for the same amount of earnings is inflationary by nature.

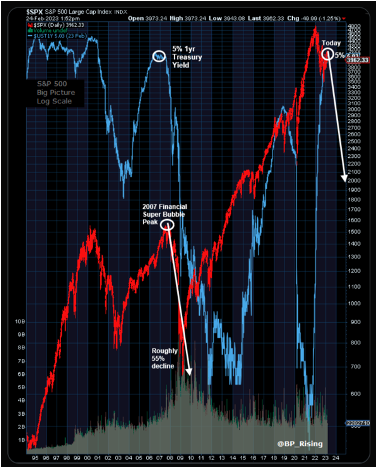

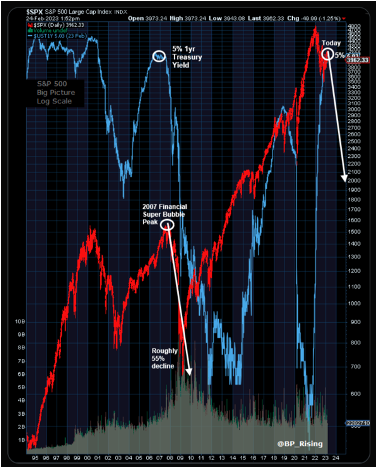

As the Fed raises rates, T-bills continue moving higher. The one-year bond has reached 5%.

And you can see how in our last two big periods of stretched valuations, the market took quite a turn.

Investors have a choice. They can either buy up 1-year T-Bonds at 5% or pay for the 1.67% earnings yield from the S&P 500 and take on equity risk.

This creates two problems at once. First, they can rotate out of equities and into bonds, quickly impacting the state of the equity markets.

Second, most Americans are getting a dismal return on their paltry bank accounts. Instead of getting less than 0.1% APR from their deposits, they can increase their payouts and buy U.S. bonds and get a real return for the first time in more than a decade.

This could place stress on deposits at the banking level, drying up consumer liquidity, and impacting the underlying lending economy.

These are important issues that investors need to consider moving forward. At Wealthpress, the team is always providing critical insight to investors and traders to help them navigate these choppy markets.

Tomorrow, Don Yochem will host Tom Busby, Jack Carter, and Celeste Lindman on “Roundtable Live.” They’ll discuss the state of these markets, rising interest rates, and the impact on equities.

In addition, you’ll get a forecast on equity outflows set for stock markets over the next twelve months.

They’ll also discuss possible catalysts to push this market higher, and the impact of the ongoing split between the East and the West, and how it will impact traders around the world.

Be sure to join tomorrow’s EXCLUSIVE live “Roundtable” right here at 10am ET: https://special.wealthpress.com/RoundTable

To your wealth,

Garrett Baldwin

Market Momentum is Red

Momentum remains red right now, and we’re currently hedged with the Proshares S&P 500 Short ETF (SPY) for the Tactical Wealth Investor. We are adding our latest position to the income portfolio starting this week. We’re also celebrating the nearly 25% return from our January shipping recommendation, and eyeing a significant amount of dealmaking that will make our new investment’s ultrasafe, inflation-crushing 9.4% dividend a must-own for the months ahead. Join me right here.