Dear Reader,

Cue the outrage machine.

Today, Exxon Mobil (XOM) reported that it had generated $56 billion in profit in 2022. The sound of teeth gnashing and fingers tweeting quickly accelerated around the halls of Congress.

But let me point something out. The purpose of a business is to make money. And the job of the executives is to maximize shareholder returns.

How is this done? Well, if you’ve followed my commentary on the Piotroski F score, you’d know that I’m looking for companies that do nine specific things that accomplish their goal.

Exxon’s board has done a perfect job. And the earnings report today was proof.

But let’s take a step back. What’s the F score?

Well, let’s review. And then, we’ll talk about other metrics that you can use to determine if a stock is cheap… and well run.

Why The F Score… Scores Big

I love this score because it helps us identify what is working in this economy… and who is managing the company correctly.

I look at three different metrics to help build a list of winning stocks that are low-risk, high-upside stocks given their rock-solid balance sheets.

- The Piotroski F-score

- The Altman Z-score

- A valuation rank

Let’s start by finding positive financial growth and low debt exposure.

That’s where the Piotroski F-Score succeeds.

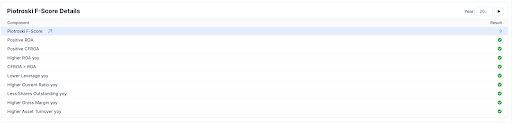

The F-score is a NINE-POINT system that rewards each company for meeting a certain criterion on its balance sheet.

If the company meets all nine criteria, it has an F-score of 9.

That means it’s perfect.

The Altman Z-score is a weighted average of five metrics to determine whether a company might go out of business.

If a company falls below 2.6, it has a risky balance sheet.

That risk is tied to a balance sheet that likely has lots of debt or weak cash flow.

We are looking for stocks with a Z-score of 3 or higher.

This is pure forensic analysis.

But let’s add one last element to this. We want our stocks to have attractive valuations. We don’t want to trade at 15 times sales. We don’t want to have a negative book value or negative EBITDA.

So, we aim for stocks with attractive buyout values.

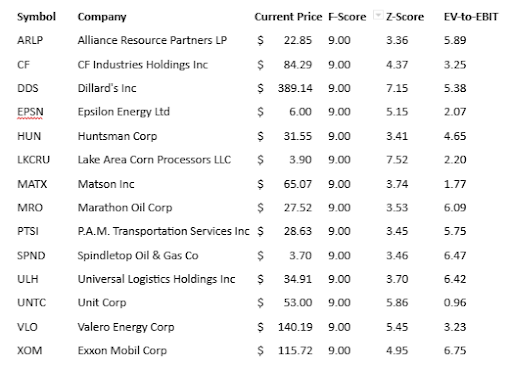

And using EV/EBITDA, we come up with this list.

Here are your top F and Z score – our “perfect stocks” – for February:

You’ll notice two key additions to this list for February.

Exxon, which just crushed earnings…

And Alliance Resource Partners LP, a stock I discussed yesterday.

Now, if you’re ready to take your investing to the next level, you need to join me tomorrow. Because I’ll be adding a new stock to our incredible long-term portfolio over at Tactical Wealth Investor.

To your wealth,

Garrett Baldwin

P.S. Please let me know if you have any feedback, questions about today’s issue or anything else. Just email us at hubfeedback@wealthpress.com.

*This is for informational and educational purposes only. There is an inherent risk in trading, so trade at your own risk.

Market Momentum is Green

The market is in a very tough window. I’m still taking gains off the January 6 momentum switch and waiting until the Fed event. This is a weird environment where we could move to 3,400… or 4,300 on the S&P 500. I’ll discuss more during Wednesday’s Roundtable with Don Yocham. You can join me right here at 10am ET. It’s free!