Dear Reader,

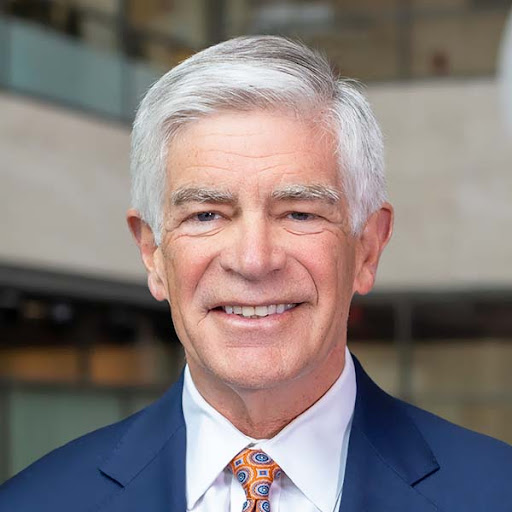

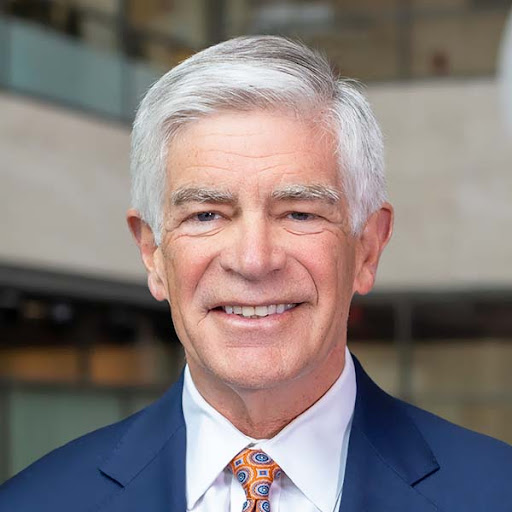

Show this man’s face on “Final Jeopardy!” and read the following clue.

“In July 1, 2015, this man became the 11th president and chief executive officer of the Federal Reserve Bank in the City of Brotherly Love. 30 seconds…”

Cue the music.

The answer doesn’t actually matter. What matters is that Philadelphia Fed Bank President Patrick Harker said this morning that he’s seen enough when it comes to inflation.

In a prepared speech given minutes after the December Consumer Price Index (CPI) came negative month-over-month (-0.1%), Harker said that the Fed wouldn’t need to aggressively front-load again on interest rates in February. He made the case that the Fed can raise rates by “just” 25 basis points during its February meeting.

Does that mean a pivot is here?

Well, not exactly. But it does bring us to the next phase of this Bear Market.

When Will They Cut?

This morning, the odds of a 25 basis point hike next month jumped to 95% at CME Fed Watch. The odds of a 50 point hike are now hard to see without a microscope.

The markets have priced in that small hike in February, and another 25 points in March.

Then, it starts to get murky. There are rate hike expectations of 5.0% in the Fed’s most recent minutes. But there are market participants now betting that cuts could come this summer – a decision that would be a stunning pivot by the central bank.

And that brings us to our next phase. We will start to shift from a period when the markets speculate when the Fed will go from rate hikes to rate cuts. And this will likely produce a period of volatility that most traders haven’t anticipated.

We’re about to enter earnings season tomorrow. We’ll get updates from the Big Banks, Delta, and a few other important names. Over the next two months, the question will center around forecasts and whether earnings compression will hit the market.

The same cycle will repeat in April, when companies report March-ending earnings figures.

Around April, as these recent rate hikes really burn through the U.S. economy (they have a lagging impact), the question will center around when the Fed will start to accommodate the U.S. economy.

And what most people don’t realize is that the Fed is very unlikely to cut until December at the earliest. That brings four earnings cycles until the Fed moves (on top of about $1 trillion total in cuts to the balance sheet.)

Instead of focusing on how much higher the Fed goes, the panic will shift into a “will they” cut rates in June… to “why aren’t they cutting” in to September… to “FOR THE LOVE OF ALL THAT IS HOLY, JEROME, PLEASE CUT INTEREST RATES FROM 5% IMMEDIATELY!” in December.

Yes, there will likely be a “pivot” in terms of the Fed’s outlook in rate cuts in 2024, but the impact of elevated interest rates has still yet to push through the economy in any real manner that cools this red-hot labor market.

What’s worse, the Fed continues to fight against a U.S. government that is still burning through money… and real interest rates remain negative (an economic force that drives consumer spending).

If and when interest rates finally get above inflation, expect the consumer economy to cool down even more as consumers finally have a reason to save money and keep it off the sideline.

We’re in a very difficult pattern right now. Expect a lot of chop again in 2023 as investors speculate around the Fed’s next major move.

The big rally that everyone wants probably won’t come until 2024. But that doesn’t mean you can’t start allocating capital to companies that make things we need: Food, energy, housing, materials.

Go long, and ignore the “pivot” talk.

To your wealth,

Garrett Baldwin

P.S. Please let me know if you have any feedback, questions about today’s issue or anything else. Just email us at hubfeedback@wealthpress.com.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

Market Momentum is Green

Our latest addition to Tactical Wealth Investor popped another 1.4%. Momentum remains positive, even though buying cooled a bit. We haven’t seen any reason for the recent rally to slow down just yet. Value stocks continue to do very well, and growth stocks continue to get a bid – largely on short-covering upside. As I noted, now is the time to build a strong portfolio for the long-term in value and income. We’re off to an incredible start in 2023. Join us as a Charter Member here.