Dear Reader,

Last Wednesday, I made you look at a picture of Jamie Dimon.

My question: Would Dimon smile or hide his face after JPMorgan Chase & Co. (NYSE: JPM) reported earnings on Friday? Even though JPM topped earnings expectations and crushed revenue projections, the stock dropped rather sharply.

The reason: Dimon warned about the state of the U.S. economy – and the bank predicted the nation would fall into a mild recession. In fact, JPM said that a “mild recession” was the base-case scenario for the year ahead.

Let’s take a look at Dimon’s statement on Friday… and discuss how you need to prepare yourself for this market.

Quantitative Tightening Looms

Here’s what Dimon said Friday morning:

“We still do not know the ultimate effect of the headwinds coming from geopolitical tensions including the war in Ukraine, the vulnerable state of energy and food supplies, persistent inflation that is eroding purchasing power and has pushed interest rates higher, and the unprecedented quantitative tightening.”

Parse through this and you see a repeat of most challenges that hit the U.S. economy in 2022. War, rising commodity prices, wage inflation, rate hikes and quantitative tightening (QT).

In addition, as I noted in my questions around earnings season last week, loan loss provisions were the big question for banks.

In the fourth quarter, loan loss provisions were much smaller than expected. On Friday, however, JPMorgan and Wells Fargo announced they were setting aside much more money than Wall Street anticipated for possible defaults in the year ahead. JPM alone set aside $2.4 billion, well above expectations for the $1.9 billion set by the Street.

So what’s causing that concern? I’d argue it’s the last part of Dimon’s statement…

QT is a real challenge that too many people — even the smartest people on Wall Street — still underestimate.

It’s not just the process of raising interest rates to maybe 5% in the next few months. It’s also the fact that the Fed is pulling liquidity out of this market at a staggering pace. The central bank will likely pull at least $1 trillion by selling assets on its massive balance sheet before it finally pivots.

This practice will also raise borrowing costs, tighten banking loan standards, and make it harder to do business in this environment.

In addition, we’ll likely see a situation where investors question the amount of money they’re willing to pay for earnings – which, too, could start to backslide in a major way in the months ahead.

The U.S. economy has barely experienced the full impact of higher rates and tightening. There’s a lag in this policy. The U.S. economy won’t be able to handle 5% interest rates for a very long time – even if the Fed argues it must keep those rates elevated to stamp out inflation.

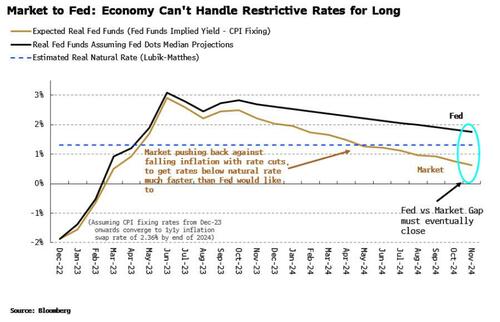

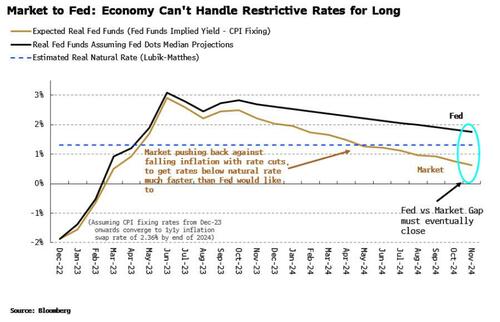

This chart from Bloomberg shows there’s a very serious market reaction to the decline in CPI, the underlying concerns about a recession and the Fed’s rate hikes. The market is trying to get interest rates lower – at a much faster pace than the Fed would like.

Yet we see a gap in projections between the market’s implied yield and the Fed’s projections. Things could go sideways very quickly for the markets without cooperation on one side or the other. This chart shows that the Fed might break something.

The Fed has hinted it will raise interest rates by 25 basis points in February. Another 25 points is likely in March. And we’ll probably see at least one more hike by May.

Then, the narrative will shift, as I explained last week.

The chart above shows that the market is begging the Fed to cut rates sooner than what the market expects. I don’t think the market will get its wish – a reason why I remain bearish about the S&P 500 regardless of a pivot (likely in the third quarter).

Be careful. And remember to focus on companies that can handle any next wave of inflation – as a trigger-happy Fed would make the same errors of the 1970s.

To your wealth,

Garrett Baldwin

P.S. Please let me know if you have any feedback, questions about today’s issue or anything else. Just email us at [email protected].

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

Market Momentum is Green

On Friday, the markets started panicking after JPMorgan reported earnings. However, the algos – once again – bought the dip and helped fuel another small pop for the day. The S&P 500 had its second weekly push higher in a row, which is bullish for momentum. I still worry that earnings could put a dent into optimism. No one ever got poor taking gains.