There are three things that arbitrage can’t touch in the markets.

I’m talking about the anomalies of insider buying, value, and momentum.

I follow these three things because they can’t be manipulated.

The numbers speak for themselves. And academia has covered this exceptionally well.

- Executives at companies experience the best source of alpha between the time they buy their stock and the time the markets announce the purchases. (Anginer, Deniz and Hoberg, Gerard and Seyhun, H. Nejat, Do Insiders Exploit Anomalies? (November 1, 2018). Marshall School of Business Working Paper No. 17-1, Available at SSRN: https://ssrn.com/abstract=2625614 or http://dx.doi.org/10.2139/ssrn.2625614)

- A portfolio of value stocks using the Piotroski F Score and the Ben Graham Number has delivered some of the best returns of the last 30 years. (Amor-Tapia, Borja and Tascon, Maria Teresa, Separating Winners from Losers: Composite Indicators Based on Fundamentals in the European Context (February 8, 2016). Finance a UVA – Czech Journal of Economics and Finance, 2016, Available at SSRN: https://ssrn.com/abstract=2729191)

- And a measurement of capital inflows and outflows through market momentum will tell you down to the day when capital is screaming out of the market or a new short-term rally is underway. (Thorp, Wayne, covering Grant Henning’s “The Value and Momentum Trader,” AAII https://www.aaii.com/journal/article/grant-hennings-technical-momentum-stock-trading-system)

Today, we want to cover explicitly the problems in this market, and why I see a sharp level of outflows dominating this market.

It could be a very long two to three weeks for retail investors, which is why I have advised readers to hedge against the current conditions.

The New Bull Market? Nope.

Today, PCE Inflation data showed that prices continue to remain elevated.

Why this is surprising to anyone makes no sense to me.

While the Fed aggressively moves to raise interest rates, Congress has dropped trillions from the sky over the last few months. Meanwhile…

Public policy makers refuse to engage in any supply-side economic support to boost the goods and services that would help alleviate prices.

Central banks around the globe keep pumping money into the system, aiding the move higher in risk assets.

There’s a reason why the Fed is concerned about the stock market’s massive rise since January.

It’s inflationary.

If Americans are looking at their 401(k) and think this market is healthy and rising, they will consume more today.

Remember, the stock market is a wealth-building device – and a rise in equities can spur spending today.

In addition, when multiples expand, that is inflationary. Investors are willing to pay MORE money today for the same amount of future expected earnings.

I stress the challenges ahead. The cost of capital is rising in the private economy while the U.S. government has no cost of capital.

So, we’re strangling productive parts of our economy in small businesses and consumer credit, while the government just drops money from the sky on the semiconductor, metals and mining, and other industries with little understanding of how supply-side economics is supposed to work.

Meanwhile, let me point a few things out…

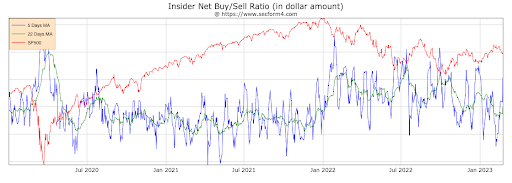

- Executives ALWAYS buy the bottom in the market. It has been this way for more than a decade. And corporate insider buying is at its lowest level… in two years. They don’t think the bottom is in yet.

- Quality matters in a real Bull market… not some stocks trading at 10 times sales with no profits. There isn’t a chapter in The Intelligent Investor saying that you should buy stocks at 130x earnings when the Fed is raising interest rates.

- There will not be a pivot unless the Fed breaks something… and I mean really breaks something. We already saw a big crack in the Bank of England and a complete debacle in the crypto markets in December.

- The most productive parts of our economy are in recessionary territory. Housing might have experienced a nice bump in December, but that was due to the ongoing market cuts in interest rates in expectation of a pivot. Now, rates are moving higher, which is bad news. As consumers continue to use plastic at an aggressive pace, we’ll get to the point where we’ll hit a wall. That’s not good.

Momentum turned negative on Tuesday, and markets are starting to accelerate a selloff.

While there will be plenty of “buy the dip” and zero-date options activity, eventually that trade won’t work, and the inactivity will clear the way for a selloff. The trend typically follows one of lower highs and lower lows.

Remember, cash is your friend as this cycle unfolds.

To your wealth,

Garrett Baldwin

Market Momentum is Red

Momentum remains in deep red territory, and some of the worst-performing stocks fall under the heavily shorted arena. I would continue to look for safety in inverse ETFs for the next two to three weeks, as this process shakes out. Or, you can start to build a portfolio of stocks poised to breakout after the Fed finally pivots. Check out Tactical Wealth Investor.