Dear Reader,

I’ve long argued that revenge shouldn’t be a process of instant retribution.

Want to really mess with someone?

Remove a brick a day from their house. If they’re not paying attention, one day you’d find them eating Cheerios in their underwear with half of a wall missing.

I jest (or do I?). I thought of this scheme while digging deeper into one of the most important areas of support for the equity markets in 2023.

And it could expose these markets in a very profound manner that weighs on valuations.

Let’s dive in…

A Pillar of Market Support Crumbles as Corporate Buybacks Dwindle

For the last 13 years, public companies have enjoyed the era of low interest rates.

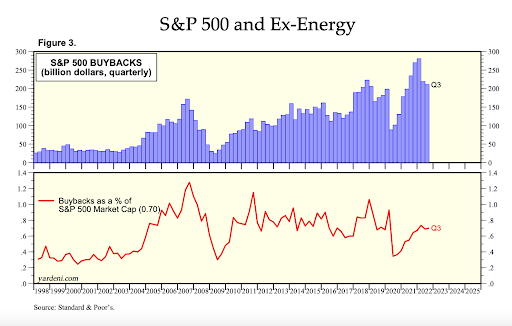

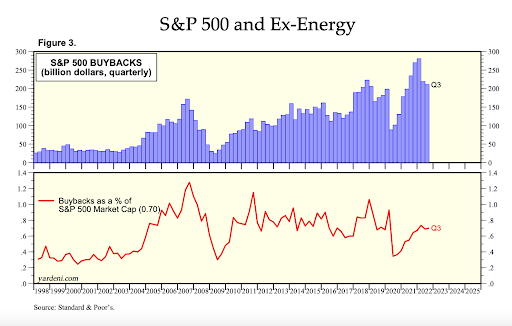

Cheap capital over more than a decade has given companies the chance to borrow money on the cheap and buy back stock. Corporate buybacks have been a major source of returns for the market over that period.

Between 2011 and 2020, it’s estimated by Yardeni Research that roughly 20% of returns on the S&P 500 came from buybacks.

Now, that figure is quite a stretch as it assumes that the money just went away. A safer estimate might be 10% of total returns over that period.

Like the Federal Reserve acts as the buyer of last resort for U.S. bonds, companies have been the buyer of last resort for their stock. And that might go away in the year ahead.

With interest rates rising and recessionary concerns looming, companies need to protect their dry powder. Two years ago, interest rates were Zero. In a few months, the Fed funds rates will hit 5%. But that’s not all…

On January 1, a new law went into effect. The Inflation Reduction Act mandates that companies pay a 1% tax on all buybacks moving forward.

In December, RBC Capital Markets warned that the “potential pillar of support” would disappear. Around the same time, Bensignor Investment Strategies sounded a similar warning…

“Corporate buybacks – a major catalyst for the bull market since the Great Financial Crisis – will likely be dramatically reduced going forward because of a new 1% excise tax on them taking effect on Jan. 1, as well as corporations no longer being able to issue almost cost-free debt (like they had been able to for several years) to finance those buybacks”.

Corporate Buybacks Slowing to a Crawl in 20203

Buybacks had already started to slow in 2022, before the law went into place.

According to S&P Dow Jones Indices, buybacks reached $981.6 billion over the 12 months through September 2022. By comparison, backpacks had reached a record $1.005 trillion posted for the 12 months through the June 2022 period.

Buybacks started to slow in Q2 of last year when interest rates started to rise. With rates poised to increase three more times this year, it’s hard to see how and why companies would ramp up buybacks in this environment.

Analysts continue to expect aggressive buybacks to reduce exposure to declining earnings in the year ahead. Come March, they anticipate that Apple will INCREASE its buyback program. That’s a very big bet, and something that I think could surprise to the downside.

The focus this year is heavily around the Fed’s balance sheet reductions and rate hikes. But one of the stories remains the impact of lower buybacks in a higher-rate environment.

This is the under-the-radar trend that can push S&P 500 earnings multiples lower…

A cut in buybacks here, a reduction in bricks from a wall there. Eventually, the foundation for a very bullish factor starts to crumble. Investors need to prepare for a downtrend.

We’ll talk more about what that means for momentum in the week ahead.

To your wealth,

Garrett Baldwin

P.S. Please let me know if you have any feedback, questions about today’s issue or anything else. Just email us at hubfeedback@wealthpress.com.

*This is for informational and educational purposes only. There is an inherent risk in trading, so trade at your own risk.

Market Momentum is Green

Momentum recovered on Friday as the “buy the dip” crowd returned with bids and short covering commenced. We reached short-term, oversold conditions on Thursday night, prompting this rally Friday. But stay vigilant. The tide appears to be turning in this market. Our Tactical Wealth Investor has seen an incredible rise in our most recent pick. Shares of this shipping company are up 9.6% to start the year. But I think we’ll see it go another 15% in the year ahead.