It’s hard to believe but December is here. And so far, the closest thing we’ve seen to the Santa Rally we’re all hoping for is the pump job we got from Federal Reserve Chair Jerome Powell on Wednesday.

Since good old J-Pow’s speech hinting the Fed could let its foot off of the interest rate gas pedal, we’ve seen a lot of choppy, sideways price action.

Markets edged down at Friday’s open after the latest jobs data came in hotter than expected — and Wall Street took that to mean the Fed could keep that rate hike pedal to the floor after all.

But it doesn’t matter if they’re doves, hawks or big, old turkeys… we’re going to keep trading that short-term institutional options flow…

When the sun is shining, you have to make that hay. And that’s exactly what the New Money Crew strategies did this week!

Follow the (Short-Term) Institutional Options Flow

The midweek pop was just the opportunity we needed to harvest some early holidays profits!

Our Weekly Blitz Alerts cooked through the long Thanksgiving weekend… We scalped a quick 41%* return with a day trade on Coca-Cola Co. (NYSE: KO) before the break…

And then followed that up with a trio of fantastic wins on Altria Group Inc. (NYSE: MO), Stellantis N.V. (NYSE: STLA) and Roblox Corp. (NYSE: RBLX), scoring 38%*, 40%* and 35%*, respectively!

All four trades smashed the 13.3% weighted average return — including all winning and losing trades — and eight-day average hold time the strategy’s inception on Feb. 21, 2020 — you love to see it!

Trades like this and the thousands of others my scanners spotted over the years are the reason I eat, sleep and breathe institutional order flow.

But if you need more proof about why you need to pay attention to these trades, then I have something you need to see.

Scanner Spots Last-Minute Miracle

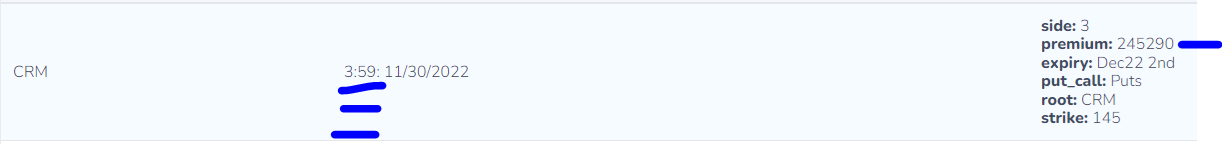

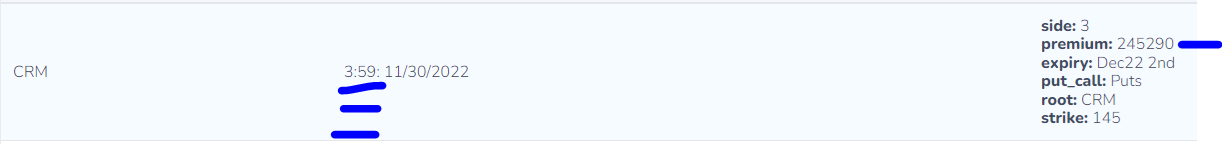

Take a look at this image right here…

That’s an order for Dec. 2 expiration, $145 strike puts on Salesforce Inc. (NYSE: CRM) — more than 1,500 contracts for over 245,000 in premium!

The company released its earnings results after the market close on Wednesday…

Salesforce ended up beating earnings expectations, but shares sank like a stone when the company announced co-CEO Bret Taylor will step down at the end of January…

Wondering what those little arrows mean and how they can help improve your trading? Get the details here!

Ouch.

Check the timestamp — the short-term options flow rolled across the wire just one single minute before the closing bell.

And those contracts went from a low of $1.54 at Wednesday’s close to a high of $4.30** within 10 minutes of Thursday’s open!

Now, I can’t prove it, but no one out there can convince me that this short-term options flow trader didn’t know something to push such a large, aggressive trade right at the close before a major catalyst.

Institutional traders love to hit option bets late in the day to keep other deep pockets from cutting in on their action…

They didn’t think we’d notice, but we did, and our New Money Crew strategies use that knowledge to bridge the information gap between the big-money institutions and retail traders like us — with great results!

This was a midweek earnings bet, but one of their favorite targets is taking trades through the weekend, and for the past year, I’ve been targeting those trades with my Wiretap Alerts strategy.

The results speak for themselves — like the monster trade we spotted on Wynn Resorts (Nasdaq: WYNN) at the end of October…

Of course, not every trade is going to be a home run, but since Sept. 24, 2021, we’ve racked up a 72.1% win rate on 179 trades, with a weighted average return of 17.5% per trade — including winners and losers… BANG!

And if you want to know more, I’m pulling back the curtain on Wiretap and two of my other favorite options strategies…

It doesn’t cost a dime to attend, and I’ll show you how I leverage them to crush the market whether it’s going up, down or sideways.

Click this link for the details.

*Stated results are atypical for given period. Past performance is not indicative of any future results. Trade at your own risk.

**This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.