President’s Day… what are we to do with a day off from the markets?

Dig into George Washington trivia?

Find out that he only had a grade-school education (it beats Yale)…

Learn that he was partially responsible for causing a world war (The French and Indian War)…

Visit the Baltimore Dental Museum where his non-wooden set of teeth sit on display (people actually hold wedding receptions at this place)…

Study his history of breeding horses and donkeys to create mules?

No… don’t go down those rabbit holes.

Let’s instead talk about the market’s state heading into the short week.

Momentum Is… Not Strong

On Friday, the primary February options expiration happened. More than $1 trillion in contracts were settled.

But in today’s environment, that number has become mundane.

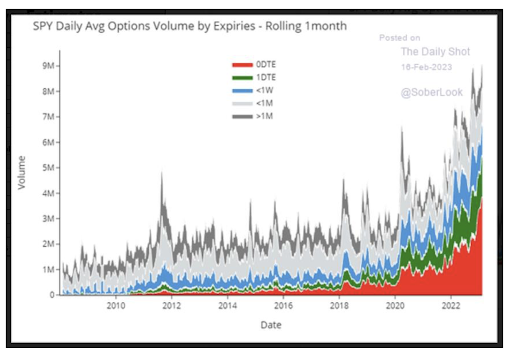

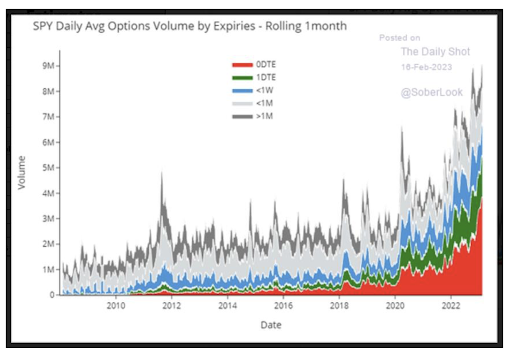

Over the last year, we’ve seen an incredible rise in the settlement of Zero Date options. These options contracts are opened and expire within 24 hours of the trading day.

The volume of ODTE and 1DTE options now comprise the bulk of options trading.

In essence, options traders are selling the contracts and effectively betting against a significant price move in the market or they’re hedging against any short-term directional move.

If someone is selling a short-term put, they’re effectively betting that the value of the S&P 500 ETF (SPY) won’t fall below the strike price (or at least the breakeven price) within the short-term duration.

In addition, short-term sellers might sell calls against underlying positions in an attempt to generate some additional income.

Here’s the problem: The sales of these options can – and will – fuel an uptick in the buying and selling of the underlying assets in the market.

Last week, JPMorgan Chase’s Marko Kolanovic warned of another possible “Volmageddon” event.

In February 2018, the markets experienced a dramatic surge in volatility and cratering in asset prices when markets suddenly worried about a massive trade war between the United States and China.

This event imploded inverse volatility options that had become a popular way to generate short-term revenue.

We had a similar implosion against low-volatility bets in March 2020 when the threat of COVID fueled widespread speculation of an economic shutdown.

Kolanovic warns that sudden covering of positions around a major event could swing the markets up or down by several percent.

He’s speaking largely of complacency.

We typically don’t see a lot of 2% to 3% days in the stock market. These events will usually happen around a large geopolitical or social event.

So, when they happen, and you have this sheer volume built around these options, the event itself may compound a dramatic move in the market.

Why does this matter?

Because when it goes… it goes. And there will be a sharp, dramatic period of position covering and margin challenges that must be addressed.

A 2% downturn can quickly cascade into a 5% to 10% move on the S&P 500 in just a few days.

That’s why I focus on Momentum. By having a simple metric that brings me down to real-time inflows and outflows in the market, I know when it’s time to get to the exits.

I can stay at the dance as long as I need to, but I’m always keeping my eye on the exit and making sure that I’m dancing as close to the door as possible.

The Week Ahead

This week, investors should keep a very close watch on three elements…

- First, Walmart (WMT) and Home Depot (HD) will report earnings. The two retail giants will give us a good sense on the health of the U.S. consumer.

- Second, the Federal Reserve will release the minutes from its February meeting. This has been a rather large risk event for the markets, as investors look for changes in the language of the Fed’s monetary policy plans. We’ll pay close attention to the Dot Plot to get a sense of how much higher the central bank may need to take interest rates in 2023. There is now an increasing probability of a 50-point hike in March.

- Third, China’s economy will be the center of attention. Alibaba (BABA) will report earnings for the quarter. This earnings report will give us a better sense of the pace of China’s reopening from COVID-19. China’s central bank has added a significant amount of liquidity in recent months to its economy, which has trickled over into global risk assets.

- Finally, keep a close eye on the PCE Inflation number. This is the Fed’s preferred inflation gauge, and what it uses to frame interest rate policy. Bank of America expects that inflation came in a bit hotter than the previous month. It’s projected a 0.5% increase month-over-month, and a 4.5% increase year-over-year.

This will be a pivotal week for the markets. Historically, the last two weeks of February are more volatile, and seasonality is usually weak.

To your wealth,

Garrett Baldwin

P.S. If you missed my big recap on the energy markets last week, you can view them each here. I gave my Top 4 energy stocks for 2023:

The Top Investment Trend For 2014 (Part 1)

The Top Investment Trend For 2014 (Part 2)

The Top Investment Trend For 2014 (Part 3)

The Top Investment Trend For 2014 (Part 4)

Market Momentum is Yellow

As we start this trading week, investors should consider taking some profits with the market under pressure. We’ve seen a downward trend since February 2. Looking forward, we anticipate a lot of volatility over the next few weeks, given the negative trend in seasonality.