Yesterday, I explained the top investment trend of 2014. It wasn’t a good one. Oil companies poured massive amounts of investor capital into the oil markets when crude pushed above $100 per barrel.

And when oil prices plunged under $40 a year later, stock prices plunged.

Despite oil prices pushing to $130 last year, many oil companies remained conservative with their approach to the markets.

Good. Responsible management rewards investors with higher dividends, large stock buybacks, and debt repayment to improve the balance sheet.

This week, I’m discussing my favorite oil stocks for the year ahead. If oil prices press back to $100, as OPEC suggested last week, these stocks could rocket in the months ahead.

That said, I really like them all for the long term. Let’s visit what looks to be the top oil stock for 2023.

Focusing on the Permian

When discovering value, it’s always smart to see what other great value investors own. That brings us to Occidental Petroleum (OXY).

The Houston-based energy company (they’re putting OXY patches on the Astros’ baseball jerseys this year) has long been a target of activist investors.

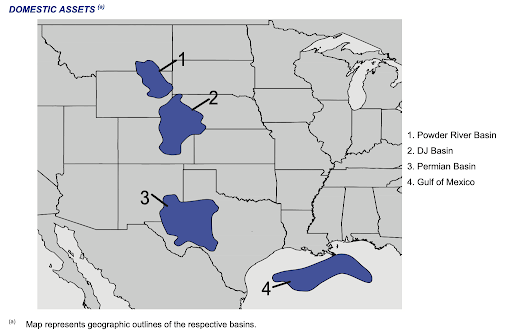

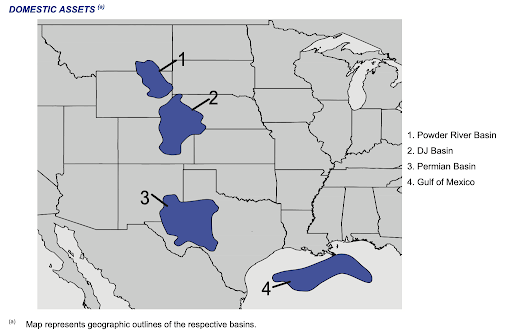

The company largely operates in petroleum production across assets owned in four basins across the United States. But don’t be confused by this map. OXY is not only one of the nation’s largest oil and gas companies in the U.S., but it also has large operations in several countries worldwide.

The company also operates in Colombia, Qatar, and Oman.

That said, its growth in recent years is directly centered on its surging output in the Permian Basin in Texas. This region is one of the most profitable oil-producing shale formations in the world.

Outside of production, Occidental owns assets in midstream and chemical businesses. It operates pipelines and storage facilities and produces petrochemicals for many industries.

From Activist to Value Investor

For years, activist hedge fund manager Carl Icahn pushed for dramatic changes to the company’s priorities. He exited his 10% stake in the company in March 2022 after three years of fighting with management over its planned purchase of Anadarko Petroleum.

Icahn earned about $1 billion for his efforts, plus hundreds of millions of dollars in warrants.

The same week that Icahn sold, Warren Buffett revealed a $5 billion stake in the company. And Buffett never stopped buying. Berkshire Hathaway has built an ever-larger stake in OXY for the last year.

It just received regulatory approval to purchase 50% of the common stock in the company, up from its current stake of roughly 22%. Berkshire also owns about $10 billion in preferred OXY shares in 2019.

Good Management, Improving Balance Sheet

Despite the run-up in oil prices in 2022, and the current uptick in prices, Occidental’s board has prioritized shareholder returns.

The company has a Piotroski F Score of 8, signaling that executives have improved the core parts of the balance sheet. Interestingly, the only point missing from a perfect score is the company’s limited efforts in reducing shares outstanding over the last year.

However, just last week, the company’s CEO Vicki Hollub said it would prioritize share buybacks over production growth in the year ahead. In addition, it is considering a deal to redeem preferred shares owned by Berkshire Hathaway.

“There won’t be significant growth from us because there’s still a lot more value to be gained for us by continuing to focus on delivering value to shareholders through share repurchases,” Hollub said in a recent interview.

In addition, the company should focus on paying off its debt. Fitch Ratings currently rates Occidental’s debt at BB+.

It’s not very far away from moving into “Investment Grade” status, which could propel Berkshire Hathaway from buying more shares. The company has aggressively been paying down debt and exploring more buybacks in the future.

In the short term, even if the market does pull back, OXY will likely attract more investment from Buffett and his company. Since 2022, Berkshire has used every pullback in OXY to purchase more shares at around the $57 level.

In addition, the company’s CEO spent millions of dollars last year on shares at a similar level. Any short-term pull back will likely see Berkshire pile back into the stock. Recent purchases have ranged in the $250 million range.

According to my estimates, so long as oil prices remain above $42, it will remain profitable. With oil looking to move back above $100, according to OPEC, we could see a big move higher.

Consider owning shares at today’s price and dollar-cost average. If shares pull back to the mid-$50s, the stock is a screaming buy.

Buffett would love to buy the stock at a cheaper price. You should do the same.

To your wealth,

Garrett Baldwin

P.S. Please let me know if you have any feedback, questions about today’s issue, or anything else. Just email us at [email protected].

*This is for informational and educational purposes only. There is an inherent risk in trading, so trade at your own risk.

Market Momentum is Yellow

If you’re looking for value in the energy sector, head over to Tactical Wealth Investor.