Did you read that subject line correctly?

Because it’s accurate.

Let’s jump back into the Time Machine. Pour some Miller High Life into Mr. Fusion. Put on whatever suspenders Marty McFly wore…

Then, we’ll drive 88 MPH into the past (where we’re going, we’re going to need roads).

One of the biggest stories of 2014 is coming back into play.

They Won’t Make the Same Mistake

In 2014, oil prices rose above $100 per barrel.

They didn’t get back above that level for another eight years. In fact, prices collapsed in late 2014 before collapsing the following year.

Why? Largely due to a mistake that oil companies made that fueled a dramatic oversupply of crude.

Back in 2014, Russia annexed Crimea. It was a major geopolitical event that helped set the tone for today’s events. But Russia’s actions didn’t impact oil prices as they did in 2022. That’s largely on the back of a supply issue that has developed recently.

Producers sought to take advantage when oil prices hovered in the $90 to $100 range between 2012 and 2014. A recent OPEC study notes that “absolute levels of upstream investment in 2012–2014, in particular,” were extremely high.

Producers were incentivized to get crude out of the ground and sell as much as possible on the open market. They poured tons of capital into new wells, exploration, and development.

But too much investment created too much supply. Shares of energy producers’ stocks plunged due to ensuing drops in oil prices.

The global oil cartel OPEC slashed production. Meanwhile, shareholders abandoned upstream energy companies in droves.

The Energy Select Sector SPDR Fund (XLE) collapsed from a peak of roughly $100 in the Summer of 2014 to the low $50s at the end of China’s 2015 crisis.

This forced energy producers to take drastic measures.

The Long and Short of The Energy Collapse

Energy stocks would again collapse in 2020 when oil prices went negative. But the companies had already started aggressive actions to reduce investment across the petroleum world.

The lesson was that investors wanted executives who took care of their balance sheet, looked out for shareholders, and didn’t chase higher prices as an excuse to pump their money into a hostile market to carbon-based fuels.

President Biden has called these companies greedy over the last year as they haven’t dramatically expanded their production.

I call them responsible. Not only are the Department of Energy and other government agencies hostile to oil-and-gas development, but also they’re looking out for shareholder interest at a time of economic uncertainty.

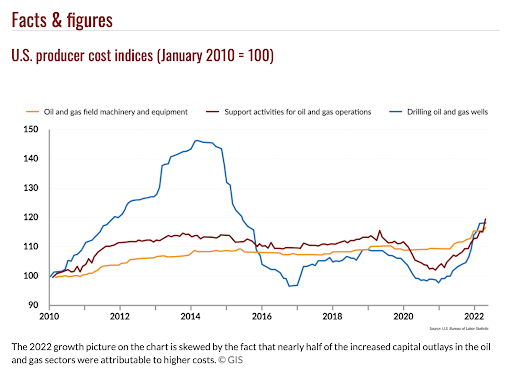

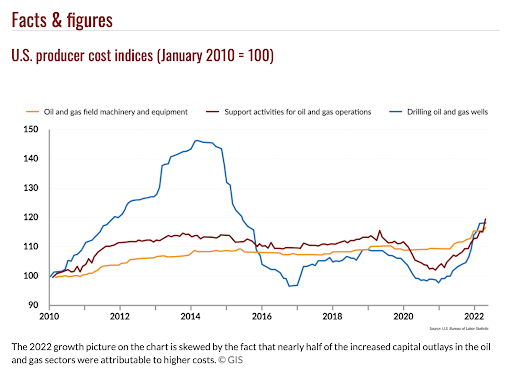

It’s not cheap to drill for wells. This Goldman Sachs chart notes that rising inflation, rising wages, and rising materials costs are pushing up the cost of production.

Most wells have a payoff period that can last decades.

Yet, various agencies have called for these wells to be “sunsetted” before they reach their payoff period. What’s the point of the investment, then… other than to provide short-term political cover?

Instead of expansion, they’re focused on shareholder returns. They’re buying back stock. They’re hiking dividends. And they’re paying off debt.

Naturally, this has created an unprecedented lack of investment in the energy markets. Last year, Goldman Sachs shined a spotlight on this problem in an alarming report.

“In upstream oil and gas, the industry at the peak was spending $900 billion per annum, which troughed at $300 billion in 2020, so a two-thirds reduction in apex. … We have exhausted all of the spare capacity in the system, and can no longer able to cope with supply disruptions like the one we are currently witnessing because of the Russia-Ukraine conflict,” the bank wrote in 2022.

Less production today means less output in the future. And it becomes a simple balance of supply and demand before an energy crisis hits.

Now, I hear someone in the back say, “Well, don’t worry about it, Garrett. Because by 2030, we’ll have a massive charging infrastructure, and we’ll run off electric vehicles.”

To that, I just say: “That’s adorable.”

Last week, I sat in on a presentation by geopolitical analyst Peter Zeihan, who was conducting a talk on globalization. He noted something that should alarm anyone hoping for a green solution…

To achieve the global green initiative, the world will require the following increases in metals by 2030, according to Zeihan:

We’ll need 3 times the amount of copper that we produce today.

- We’ll also need 4x the Chromium.

- We’ll need 10x the Lithium.

- We’ll need 10x the Nickel.

- And we’ll need 18x the Graphite.

Is that possible? Not even close.

There are three reasons. And it all involves basic math.

We’ve never been able to double the industrial capacity of any metal (that’s 2x) in a decade at any point. Yet, we’re suddenly going to do this at even larger scales for those five critical elements?

And second, to do so, we’ll need the help and cooperation of Russia (which seems occupied right now). Russia is a Top 4 producer of all these metals.

Finally, China has largely contracted most of those industrial metals from other critical mining regions at the state level (not at the company level).

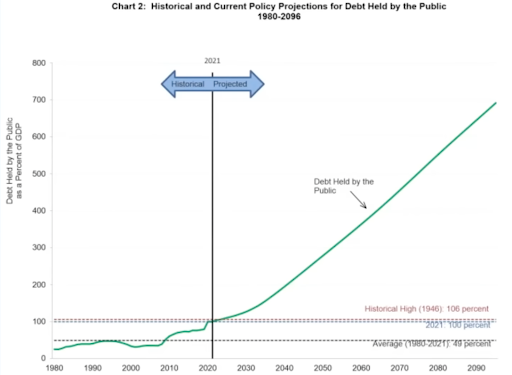

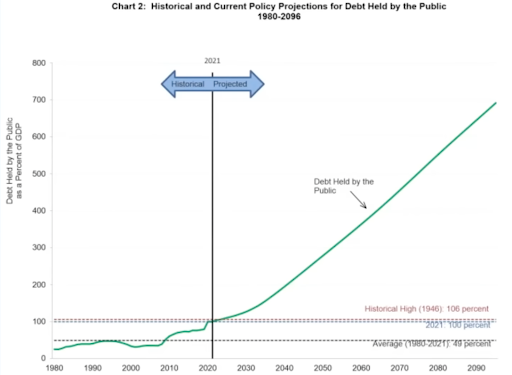

If we keep sidelining carbon-based energy and pushing for this impossible dream that we’ll magically achieve these goals by 2030, we’re facing an energy crisis on top of a debt crisis (we’ll easily be past $45 trillion in debt by 2030).

The chart below was actually published by the U.S. Treasury Department this year.

So, what am I doing?

Sticking with oil companies.

I’ll make the case tomorrow for an oil trade each day this week.

We’ll start with Occidental Petroleum (OXY).

To your wealth,

Garrett Baldwin

*This is for informational and educational purposes only. There is an inherent risk in trading, so trade at your own risk.

Market Momentum is Yellow

If you’re looking for value in the energy sector, head over to Tactical Wealth Investor. With momentum in the Yellow territory, now is the time to focus on value and income. We’re still facing a nasty selloff as sectors break down on low volume trading. We’re likely facing a 2% to 3% down day in the next ten trading days.