All this week, we’ve discussed the opportunities emerging for investors across the energy sector.

Naturally, people are concerned about the recent pullback in oil prices. A string of negative economic data points suggest that the U.S. might face recession – or at least feeble growth.

As I’ve noted, especially at Tactical Wealth Investor, now is the time to look at the long-term energy trend. Production prices are rising. The cost of capital is too.

Russia is taking crude off the global market, while China’s stimulus packages goose demand across the world’s second-largest economy.

Regardless of how much money the U.S. government throws at renewables, the U.S. Energy Department still notes that fuel demand will remain very robust through the 2050s.

The trend suggests higher… for longer.

And that is why we want to tap into our final free recommendation today.

There’s Always Money in the Midstream

For the last three days, I’ve explained the benefits of owning energy stocks in the exploration and production (E&P) space. These companies operate in the upstream portion of the energy supply chain.

They discover and extract oil from the ground. They then send the energy downstream through pipelines, railways, and other transportation means to refineries and other companies that will convert oil into petroleum-based products.

Some companies like British Petroleum (BP) and Chevron (CVX) have their own integrated operations that take fuel from the ground, process it, convert it to gasoline, and ultimately sell it at the retail level.

Other companies like Occidental (OXY) are largely pure players in the production space. These producers need to work with Midstream companies that connect them to the downstream operators.

Again, companies that own pipelines and storage space that experience high demand when producers pull more energy commodities out of the ground and send them downstream to the refineries and manufacturers.

The midstream is a very cash-rich area. And nowhere are there better operations for income investors than in Master Limited Partnerships.

These companies are structured as partnerships (not as traditional corporations). If the companies generate the bulk of their revenue from their pipelines and distribute 90% of their profits to unitholders, they bypass corporate taxes.

This means that investors only pay their dividends as ordinary income – and avoid the need to pay at the corporate level.

Perhaps my favorite of all MLPs today is the company Enterprise Product Partners (EPD).

The King of the Midstream

Enterprise Product Partners owns 260 million barrels of storage capacity for fuels across the United States.

It also manages a stunning 50,000 miles of pipelines, bringing fuel from production fields to end users. That’s enough pipeline to wrap around the earth… twice.

EPD manages its risk very well, with about 90% of its revenue contracted through fixed agreements. This enables the company to hedge against any violent price swings in underlying crude prices.

Many energy companies are considering dividend cuts due to rising production costs. But EPD is running with a 7.4% dividend, and it has increased its yield for 24 straight years.

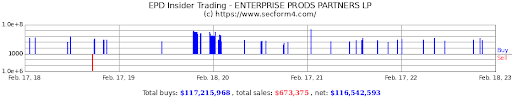

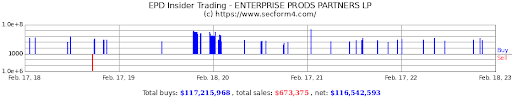

Even more bullish, executives at the company have been net buyers of the stock for the last five years.

As you can see, executives have bought more than $117 million in shares in the last few years, while selling only happened in one large sale by a single executive in late 2018.

It’s always good news when the executives have skin in the game and use their own money to buy shares.

It’s a very bullish sign. If you want to tap into the top MLPs, remember that there is always money in midstream energy.

If you want my top MLP pick, take a look at Tactical Wealth Investor, which has an energy player with a 12.2% dividend that is safe and secure.

To your wealth,

Garrett Baldwin

P.S. If you missed my articles on the energy sector earlier this week, you can view them each here:

The Top Investment Trend For 2014 (Part 1)

The Top Investment Trend For 2014 (Part 2)

The Top Investment Trend For 2014 (Part 3)

The Top Investment Trend For 2014 (Part 4)

Market Momentum is Yellow

February options expiration is today, and investors are increasingly worried that the ongoing surge of Zero Date Options (ODTE) could fuel a dramatic downturn in the near future. I’ve moved to cash and continue to look for ways to short this market, should it roll over into next week. The final two weeks of February are historically periods of market weakness.