Right now, the energy markets are caught up in a tale of two narratives. On one side, you have the ongoing threat of a rolling recession here in the United States and a slowdown in global economic activity.

Meanwhile, you have a massive threat to supply in Russia’s ongoing war on Ukraine, and the expected surge in demand from China during its COVID reopening.

Central banks across Europe and Asia have dropped a massive swell of liquidity from the sky.

And WTI crude continually finds support around $75 per barrel.

While $75 per barrel might not be as “profitable” as some of the calls for $100 to $120 oil by Q3 this year, that figure is still a terrific output number for U.S. oil and gas companies.

In the Permian Basin, many producers are minting cash at a breakeven price between $40 and $50 per barrel.

As I’ve noted, like in 2014, companies have been careful not to over expand production. Doing so has padded their margins, boosted cash flow, and helped them reward shareholders for their patience.

Today, I want to highlight yet another long-term energy play that can provide a strong, steady cash flow for your portfolio.

Focus on the Balance Sheet… Please!

A few weeks ago on “Roundtable”, Roger Scott and I discussed the top energy stocks for the year ahead. Unsurprisingly, he listed Chevron (CVX) as a candidate for the top-performing stock of 2023.

I typically keep my focus on U.S.-only production. Chevron’s upstream portfolio places its facilities on every continent except Antarctica.

The company produces a large amount of oil in North America. But the share of its portfolio in North America is barely larger than its output in Africa & Latin America, Europe & the Middle East, and Asia-Pacific.

Let’s look at where Chevron produces around the globe:

But in the world of finance, all rules remain the same when it comes to solid balance sheets and share value.

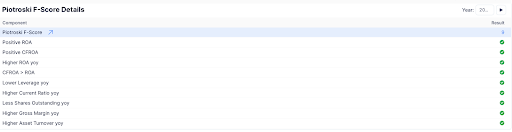

Chevron has a perfect balance sheet with a Piotrotski Score of 9. With the F Score, a company receives a point for each balance sheet metrics listed below.

The company recently announced a $75 billion buyback program for its outstanding shares (it gets a point for fewer shares outstanding year-over-year.)

To put that buyback into perspective, the program is larger than the market capitalization of all but 12 U.S. oil producers.

The stock trades within the range of the Graham Number, a defensive stock price that analyzes both the company’s earnings per share and its book value.

The Graham price, which investors should be comfortable paying for the shares, is about $185. That represents an attractive upside from current levels.

And since we can anticipate that Chevron will improve both its EPS and book value in the future, this defensive figure should increase every time that we see the company report earnings.

In addition, it hiked its dividend once again by 6%.

Understanding Production

The most interesting part of the company’s recent earnings report was the news it had cut production globally.

The company had ended a contract in Thailand and Indonesia that altered its final output figures. But it did increase its output by 4% in the Permian Basin, one of the most capital-efficient regions for drilling in North America.

Even though its production guidance was muted, the company’s cash flow remains robust. In Q4, its cash flow came in at $12.5 billion, an increase of nearly $3 billion year-over-year.

Chevron is showing strength in efficiency. And because of rising CAPEX costs, its management is making the right decision.

Instead of testing its margins, the executives are just returning excess capital to shareholders and boosting the price.

The company’s balance sheet is in prime condition for whatever comes in the energy markets in the years ahead.

Its net-debt-to-equity ratio sits at a paltry 0.05x, which is better than its peers in Exxon (XOM), ConocoPhillips (COP), Occidental (OXY), and Marathon (MRO). And I’m a fan of all four of these competitors.

My view is that oil prices are heading higher, not lower.

Demand should rise through the reopening of China. Capital investment is falling in the space, complicating the supply picture for the years ahead.

And any event in Russia or the Middle East that increases the geopolitical premium will boost oil prices. I’m content to own one of the premier oil majors, given their strong balance sheet and commitment to shareholder interest.

To your wealth,

Garrett Baldwin

P.S. If you missed my articles on the energy sector earlier this week, you can view them each here:

The Top Investment Trend For 2014 (Part 1)

The Top Investment Trend For 2014 (Part 2)

The Top Investment Trend For 2014 (Part 3)

Market Momentum is Green

If you’re looking for value in the energy sector, head over to Tactical Wealth Investor. This market continues to defy logic as liquidity pours into the global system with zero regards for a pending correction. The 2020 YOLO market is back for now. Trade with positive momentum, and set tight stops.